Jham V. (2008). Customer adoption of multi channel usage: an empirical investigation of the banking industry. Global Academic Society Journal: Social Science Insight, Vol. 1, No. 4, pp. 38-47. ISSN 2029-0365. [www.ScholarArticles.net]

Author:

dr. Vimi Jham, Institute of Management Technology, India

Abstract

Banks in India have succeeded in promoting new services to its customers. The likelihood of current customers is tempted to do business online. The study sought to investigate factors that influenced Indian bank customers‟ adoption of three major banking channels, i.e. branch banking, ATM and Internet banking. Based on extant literature on bank marketing and interviews with bank managers in India, a questionnaire was designed. Then, in a large-scale survey by means of personal and telephone interviews, data was obtained from bank customers. This paper focuses on the adoption of multi channel banking by existing banks customers through an investigation of the factors that influence customer‟s acceptance of multi channel banking services. An exploratory study of the Indian customers in six banks is conducted to identify the factors which lead to adoption of multi channel banking services with the help of data reduction technique called Factor Analysis.

Introduction

As information technology becomes more and more sophisticated, banks in many parts of the world are adopting a multiple-channel strategy. Globally, the number of websites increased from 23,000 in 1995 to more than 55 million in 2005 (Zakon, 2005). The amount of Internet marketing research had grown dramatically since the review conducted by Ngai (2003) thus the right mix of banking channels depends not only on the channel characteristics, but also on the preferences of the consumers within a particular market. The challenge for bank marketers is to find the right mix of distribution channels so that they can remain profitable in different market segments. To this end, bank marketers have to understand why their customers like or dislike a particular channel. An understanding of the factors that have bearings on the adoption of different banking channels can help a bank adjust its marketing strategies. The present study aims to obtain insights into the factors that can influence adoption of banking channels among Indian bank customers.

Literature survey of multi channel banking

There is need for research to identify the factors that determine adoption of various channels provided by the bank. Significant effect of computer self-efficacy on behavioural intention through perceived ease of use, perceived usefulness, and perceived credibility is still to be assessed with the banking sector. Traditional branch-based retail banking remains the most widespread method for conducting banking transactions in India as well as any other country. However, Internet technology is rapidly changing the way personal financial services are being designed and delivered. In India banks have tried to introduce Internet-based e-banking systems to improve their operations and to reduce costs. Despite all their efforts aimed at developing better and easier Internet banking systems, these systems remained largely unnoticed by the customers, and certainly underused in spite of their availability. Holbrook and Hulburt (2002), McCole (2004) have made a compelling argument that the Internet is simply a new and evolving marketing channel that will find its place into the marketing mix of some, but certainly not all organizations. At the 2005 Direct Marketing Association‟s annual conference, much of the buzz from Internet practitioners pertained to multi channel consumer strategies seemly supporting this point of view. As Davis (1989) noted, future technology acceptance research needs to address how other variables affect usefulness, ease of use, and user acceptance. However, factors affecting the acceptance of a new IT are likely to vary with the technology, target users, and context (Moon and Kim, 2001). Recent research has indicated that trust has a striking influence on user willingness to engage in online exchanges of money and personal sensitive information (e.g. Hoffman et al., 1999; Friedman et al., 2000). The first dimension of trust, perceived credibility, is the extent to which one partner believes that the other partner has the required expertise to perform the job effectively and reliably (Ganesan, 1994). The second dimension of trust is benevolence. Benevolence is rooted in repeated buyer-seller relationships (Ring and Van de Ven, 1992; Zaheer et al., 1998). Perceived credibility is usually impersonal and relies on reputation, information and economic reasoning (Pavlou, 2001). It is more related to one‟s judgment on the privacy and security issues of the Internet banking systems. Consequently, perceived credibility is used as a new construct to reflect the security and privacy concerns in the acceptance of Internet banking. Previous studies have found that in banking service, product quality plays an important role in determining customers‟ perceptions of the overall banking service quality. The bank product quality is primarily associated with product variety and diverse features. Strieter et al. (1999) noted that one of the most important developments in banking is the increased emphasis on marketing a wide array of financial services. Dixon (1999) also argued that the key to getting more customers for the banks through online service is not attraction of the Internet itself but the product offered to the customers. This argument was supposed by Latimore et al., (2000), who found that 87 percent of Internet banking customers want to make a variety of financial transaction at one side (so called “one-stop shopping”), including paying their bills electronically and automatically, viewing their monthly bank statements, and purchasing stocks and insurance. Therefore it could be noted that since the present banking customers, with the advent of the Internet technology, can have unlimited access to financial information and enjoy a wider range of choice in selecting competitive products and financial institution than ever before, the subtle “differentiating” quality levels (e.g. diverse features) of bank products and their timely introduction on the marketplace have become a key driving force in attracting new customers and enhancing customer satisfaction (Moles, 2000). As electronic banking becomes more wide spread, managers of financial institutions need to be able to assess the impact of losing relationships and accounts to aggressive online alternatives. Kennickell and Myron (1997) examined the determinants of demand for electronic media for financial transactions; they found that the likelihood of using electronic media to obtain banking services rises with higher levels of financial assets and education. Additionally, younger consumers tend to use computers, ATMs, and debit cards more. However, the use of direct deposit rises with age. Kolodinsky et al. (2000) also found that age and education has an influence on whether consumers use electronic banking products. However, they conclude that positive attitudes toward e-banking services matter more than demographic factors in determining whether such services are used. These items included statements related to perceived use, convenience, relative advantages and risk associated with electronic banking. Mantel (2000) investigated the factors that influence consumers‟ willingness to use electronic bill payment. Jeevan (2000) observes that the Internet enables banks to offer low cost, high value added financial services. Banks as well as consumers view the security threat as perhaps the most serious threat. Denny (2000) observes that the security of Internet access to client account is the biggest challenge facing banks. One of the major factors affecting the banks is the changing need and perceptions of the consumer (Rose, 2000). Increasingly, consumers expect online services from their financial institutions (Constantine, 2000) and electronic delivery of services is becoming a necessity. Multiple branches spread across the country and lack of national bandwidth are major constraints, especially for public sector banks (Varma, 2001). 65% of these banks are plagued with union issues, inertia and apathy towards online channels in India. With somewhat restricted growth of foreign banks due to their perceived expensive services, private entrepreneurial banks have pulled ahead. With deregulation and increasing competition from private and foreign banks, Indian banks had to gear up their technology infrastructure to get competitive edge on online service delivery (Jeevan, 2000). The lack of telecoms infrastructure and PC penetration is still a major problem for Indian banks.

Objective of the study & gaps in research

Perceived ease of use and perceived usefulness may not fully reflect the users‟ intention to adopt multi channels banking, necessitating a search for additional factors that better predict the acceptance of Internet banking. Several important external variables that have received more and more attention such as individual differences, computer self-efficacy as suggested by research (Agarwal and Prasad, 1999). Individual differences refer to user factors that include traits such as personality and demographic variables, as well as situational variables that account for differences attributable to circumstances such as experience and training. Furthermore, there has been no such empirical research to explicate how individual differences influence the usage intention of Internet banking. Numerous individual difference variables have been studied, including demographic and situational variables, cognitive variables, and personality-related variables (Zumd, 1979). This research paper attempts to fill this gap and identifies the various factors which will enhance the usage and adoption of multiple channels which banks in India provide the customer.

Research methodology

The questionnaire was designed from the literature review. It included 33 variables which help to gain an understanding of the channel adoption factors of Indian bank customers. Six Indian banks were chosen where the questionnaire was randomly administered to 210 respondents who were also customers of the bank. Out of 210 questionnaires, 196 were completed questionnaires. The banks chosen for the purpose of the study were the ones who have strong retail presence and offer comprehensive range of information to the customer. The 33 variables were measured with the help of 7 point semantic scale ranging from extremely satisfied to extremely dissatisfied, (where 1- extremely dissatisfied, and 7- extremely satisfied). The responses were transposed from spreadsheet to SPSS where these 33 variables were reduced to four principal components.

Analysis of the data

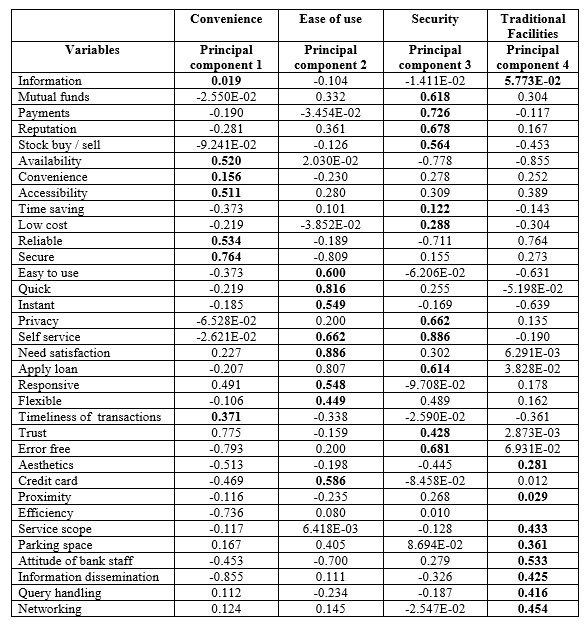

The data was subjected to Principal Component Analysis, a method categorized under the broad area of Factor Analysis. The 33 variables were reduced to 4 principal components through varimax rotation method (see Table 1). Factor Analysis is a multivariate statistical procedure primarily used for data reduction and summarisation – large number of correlated variables is reduced to set of independent underlying factors. In our sample the Kaiser-Meyer-Olkin measure of sampling adequacy was 0.716, i.e. greater than 0.5. This suggests that the data is adequate for Factor Analysis.

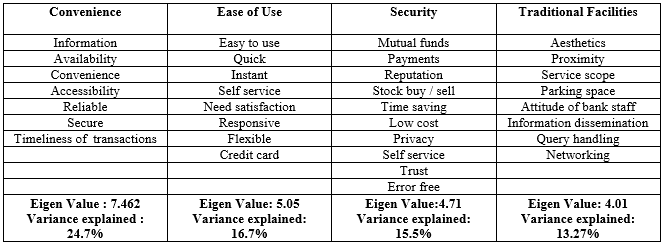

After extracting the Eigen values of the four factors and the percent of variance explained by them as shown in Table 2, rotation of principal components is done through varimax rotation. After the number of extracted factors is decided upon, the next task is to interpret the name of the factors as shown below. This is done by the process of identifying which factors are associated with which of the original variables. Factor Analysis was used to summarize the 33 “channel adoption factors” into smaller sets of linear composites that preserved most of the information in the original data set.

Table 1. Identification of Principal Components

Factor one had all the statements dealing with convenience. Factor two had all the statements related to ease of use. The third factor had statements related to security issues. The fourth factor had traditional facilities which a customer looks for when he / she uses the traditional channel (see Table 1).

Table 2. Factors for channel adoption in Indian Banks

Table 2. Factors for channel adoption in Indian Banks

The factor loadings for the variables can be seen in Table 1. The largest factor loading for the variable is marked is bold. Table 2 represents the variables represented in the four identified principal components.

Results of the interviews

Branch banking. Undoubtedly, many banks are trying to reduce the resources needed by branch banking. However, it is still premature to talk about the operation of an entirely Internetbased bank in India. Physical bank branches with human tellers and service providers are still indispensable because this channel is needed for:

- first-time bank customers who need to open accounts;

- complicated services, such as mortgages or making remittances;

- Face-to-face service encounters where personal identification is essential.

The cost of branch banking is quite high compared to other banking channels. Furthermore, branch banking appears to be the least profitable market segment. According to the findings of the present study, the consumers of branch banking consist primarily of the people who are financially and cognitively less resourceful, but have plenty of time. Given these findings, how should branch banking be positioned? It may be suggested that two market segments should be differentiated for branch banking. The first market segment, as mentioned above, includes those who are less financially and cognitively resourceful, but have plenty of time. They rely primarily on branch banking and visit bank branches regularly. This market segment is likely to be the majority of customers visiting a bank branch. These customers tend to use only the basic banking services, such as withdrawing cash, checking account balances, and transferring funds between accounts. Counters providing only basic banking services are sufficient to satisfy most of these customers‟ needs. The second market segment includes those who primarily adopt other banking channels, such as ATM or Internet banking, but occasionally have the need to go to a bank branch in person for certain transactions. For this market segment, the strategic goals of the bank should be relationship building. The bank should not consider these contacts to be cost inducing, but regard these contacts as precious business opportunities. Not many of these customers would frequently use the services of branch banking: the bank can afford to devote more manpower to serve each of these customers. The bank staff should emphasize their service quality, and try to develop a commercial friendship with these customers. Over time, the bank should find such personal relationships to be profitable because of the higher level of customer retention and greater potential of cross-selling.

ATM. ATM was highly adopted by all bank customers, and adoption of it was positively associated with beliefs about its positive attributes. Informativeness seemed to be the weakest aspect of ATM banking. The ATM channel manager should seek ways to enhance informational content in this channel. For example, more financial information can be presented to the bank customers on the ATM display.

Internet banking. Among the three banking channels, Internet banking holds the greatest potential for development in the banking industry in India. This is because the level of adoption is still not very high – the market is not yet saturated. According to statistics compiled by NetRatings of ACNielsen (The Times of India News Service, 2001), Internet banking is expanding rapidly. Interestingly, beliefs about the convenience of Internet banking were not correlated with its adoption. Perhaps most bank customers were fully aware of the payments, trust and privacy Internet banking could bring. What really mattered were the other three attributes of the channel (i.e. informativeness, user-friendliness, and assurance). These are the areas in which channel managers have to work hard.

Satisfaction of the customer with multi channel usage

According to the research, the customer uses multiple channels for convenience, ease of use, security and to access traditional facilities. The customer prefers using a secure mode of transaction when money is involved. Privacy and trust play an important role in the usage of the Internet but the satisfaction with these parameters is very low. High satisfaction is indicated with buying and selling of stocks convenience, as a time saver, self service, easy to use, getting bank information and general information, timeliness and flexibility with the use of internet banking.

Discussions and managerial implications

This study provides us with a comprehensive picture of what a customer look at when using multi channel facility provided by the banks. Thus it provides an insight into how banks should allocate resources among the multi channel facility it provides to the customers. Overall, the banking channel that was most frequently used in India is the ATMs, followed by branch banking and Internet banking. It is interesting to note that the level of convenience, ease of use and security are important factors for any kind of banking. Indeed, there is an exponential growth of fraudulent activities on the Internet with ever more sophisticated and better organized virtual thieves (Richmond, 2005). More research is thus needed that addresses the ever-widening nature of trust and its impact on Internet usage. Related to the trust issue is government regulation and how this will impact Internet marketing, particularly in terms of how consumer protection. Unfortunately, few marketing scholars are equipped to work in this area and even fewer have research experience with these topics. The strength of branch banking therefore seems to provide level of assurance, probably because transaction accuracy and security could be maintained more effectively in face-to-face transactions without reliance on an electronic medium. Although ATM is believed to be the weakest in the level of informativeness, it is the most frequently used banking channel. This is probably due to its high level of convenience provided to customers. Although Internet banking is also believed to have a high level of convenience, Internet banking could not beat ATM because ATM is the only channel that allows cash withdrawal 24 hours a day and does not require the customers to have access to computer facilities.

References

- Agarwal R., Prasad J. (1999) Are individual differences germane to the acceptance of new information technologies? Decision Sciences, Vol. 30, No. 2, pp. 361-391.

- Constantine G. (2000) Banks provide Intent on-ramp. Hoosier Banker, Indianapolis, March, USA.

- Davis F. D. (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, Vol. 13, No. 3, pp. 318-339.

- Denny S. (2000) The Electronic Commerce Challenge. Journal of Internet Banking and Commerce, November, Vol. 3, No. 3.

- Dixon M (1999) .com madness: 9 must-know tips for putting your bank online. America‟s community banker, Vol. 8, No. 6, pp. 12-15.

- Friedman B., Kahn P. H. Jr, Howe D. C. (2000) Trust online. Communications of the ACM, Vol. 43, No. 12, pp. 34-40.

- Ganesan S. (1994) Determinants of long-term orientation in buyer-seller relationships. Journal of Marketing, Vol. 58, No. 2, pp. 1-19.

- Hoffman D. L., Novak T. P., Peralta M. (1999) Building consumer trust online. Comuunications of the ACM, Vol. 42, No. 4, pp. 80-85.

- Holbrook M. B., Hulburt, J. M. (2002). Elegy on the death of marketing. European Journal of Marketing, Vol. 36, Nos. 5/6, pp. 706-732.

- Jeevan M. T. (2000) Only Banks – No Bricks. Voice and Data, November 11 Available at: http://www.voicendata.com/ content/convergence/trends/ 10011102.asp.

- Kennickell A. B., Myron L. K (1997) Who Uses Electronic Banking? Results from the 1995 Survey of Consumer Finances. Working Paper, Board of Governors of the Federal Reserve System, July.

- Kolodinsky J., Hogarth J. M., Shue J. F. (2000) Bricks or Clicks? Consumers‟ Adoption of Electronic Banking Technologies. Consumer Interests Annual, Vol. 46, pp. 180-184.

- Latimore D., Watson I., Maver C. (2000) The customer speaks: 3,300 Internet users tell us what they want from retail financial services. Available at: http://www.mainspring.com/research/document/view/ 1,2099,1215,00.html.

- Mantel B. (2000) Why Do Consumers Pay Bills Electronically? An Empirical Analysis. Economic Perspectives, Federal Reserve Bank of Chicago, Vol. 24 No.4, pp. 32-47.

- McCole P. (2004) Marketing is not dead: a response to „Elegy on the death of marketing‟. European Journal of Marketing, Vol. 38, Nos. 11/12, pp. 1349-1354.

- Moles N. P. (2000) The Internet and services marketing – the case of Danish retail banking. Internet Research: Electronic networking Applications and policy, Vol. 10, No. 4, pp. 154-69.

- Moon J. W., Kim Y. G. (2001) Extending the TAM for a World-Wide-Web context. Information & Management, Vol. 38, No. 4, pp. 217-30.

- Ngai E. W. T. (2003) Internet marketing research (1987-2000): a literature review and classification. European Journal of Marketing, Vol. 37, Nos. 1/2, pp. 24-49.

- Pavlou P. A. (2001) Consumer intentions to adopt electronic commerce – incorporating trust and risk in the technology acceptance model. Proceedings of the Diffusion Interest Group in Information Technology Conference (DIGIT2001), Sunday 16 December, New Orleans, LA.

- Richmond R. (2005) Hacker attacks grow; more key to identity fraud. The Wall Street Journal, March 21, p. B5.

- Ring P. S., Van de Ven A. H. (1992) Structuring cooperative relationships between organizations. Strategic Management Journal, Vol. 13, pp. 483-498.

- Rose S. (2000) The truth about online banking. Money, Vol. 29, No. 4, pp. 321-333.

- Strieter J., Gupta A. K., Raj S. P. Wilemon D. (1999) Product management and marketing of financial services. International Journal of Bank Marketing, Vol. 17, No. 7, pp. 342-354.

- The Times of India News Service (2001) AC Neilsen to close RMS division. 15 March 2001. Available at: Timesofindia.indiatimes.com/articleshow/34253070.cms.

- Varma Y. (2001) Banking: The network is the bank, Public Sector : why the lag? Dataquest, January 29th. Available at: http://www.dqindia.com/content/top_stories/301012904.asp.

- Zakon R. H. (2005) Hobbes‟ internet timeline 1993-2005. Available at: www.zakon.org/robert/ internet/timeline/.

- Zumd R. W. (1979) Individual differences and MIS success: a review of the empirical literature. Management Science, Vol. 25, No. 10, pp. 966-979.

- Zaheer A., McEvily B., Perrone V. (1998) Does trust matter? Exploring the effects of inter organizational and interpersonal trust of performance. Organization Science, Vol. 9, No. 2, pp. 141-159.