Mukhopadhyay T. (2009). A study on micro structures in Indian foreign exchange market and the role of Central Bank. Global Academic Society Journal: Social Science Insight, Vol. 2, No. 6, pp. 4-23. ISSN 2029-0365. [www.ScholarArticles.net]

Author:

Tilak Mukhopadhyay, Indira Gandhi Institute of Development Research (IGIDR), India

Abstract

The present study examines the relevance of macroeconomic models vis-à-vis models based on the market microstructure theory in the context of short-run behaviour of the Indian foreign exchange market. In specific, the paper aims to investigate the relative importance of macro (domestic interest rates) and micro (order flows and number of transactions) variables in determining the short-run exchange rate movements. Empirical analysis is based on secondary data of Indian foreign exchange market and money market. Analysis of the secondary data reveals that micro variables (order flow) have a stronger impact on the exchange rate movement compared to macro fundamentals. In long run the macro variables have significant effect on exchange rate movements but in the short run the market is basically influenced by the micro variables such as market movement, speculation, Central Bank intervention, etc. One of the major findings of this study would be that the Central Bank intervention has a major impact on speculations and hence it reduces volatility but increases market inefficiency.

Introduction

In recent past India has experienced a higher volatility in the foreign exchange market. Therefore a study on exchange rate movement has become quite relevant in this present time. Many research projects are going on focusing on some perennial questions, such as: what are the determinants of exchange rate? Do exchange rates follow a specific pattern? Is there any theory that can help us in predicting the rate movements? Many approaches developed in the area of open economy macroeconomics have tried to address these questions. However, these approaches have had some success in explaining currency movements only in the medium and the long-term. But these macro fundamental theories however, could offer no explanation for the short run exchange rate movements in the market (Evans and Lyons, 2002). Specially, the role of macro variables such as interest rate has been questioned by many researchers to explain the short run volatility of exchange rate. So the question that remains in the short run: what are the factors that affect the dealers‟ decision-making? In the literature it was found that more than macroeconomic fundamentals, the dealers consider other variables that are micro in nature (Lyons, 1995). The micro variables are bid-ask spreads, trading volume, own volatility, information (both private and public), inventory cost, etc. In the financial economics literature, to study the behaviour of asset prices and the market participants, the researchers mostly use the market microstructure theory, which is the only theory that considers all the micro variables. So this study explains the level of influence of macro variables such as Indian interest rate (called money rates) and some micro variables such as order flow and number of quotes in Indian rupee/US dollar (INR/USD) taken place in a day through interbank dealings (particularly through Reuters D 2000-2 system). In Indian context as the foreign exchange market is a “managed exchange rate regime”, the role of Reserve Bank of India (RBI) in long run as well as short run are very crucial on the movements of exchange rate. The long run impact of Central Bank intervention in Indian foreign exchange market has been quite significant (Ghosh, 2002). This paper examines the short run effect of RBI intervention in foreign exchange market through different policy announcements by constructing a dummy variable model with suitable macro and micro variable. This paper is organized as follows. At first, one of the alternative theories on asset price determination in the finance literature (namely market microstructure theory) is discussed briefly. Second section contains a review of the existing empirical literature. Further, the specific objectives and database used in this study are given. Finally, the paper discusses the empirical findings based on secondary data. Accordingly the conclusions and some open ended questions are left for the further research work in the last section.

Market microstructure theory

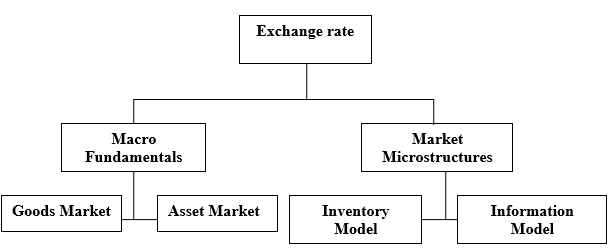

This paper questions the relevance of macro theories in explaining and predicting day-to day movements in the foreign exchange market. It is implicitly acknowledged that speculation is the most important aspect of intraday/day-to-day transactions in the foreign exchange markets rather than fundamentals. This is because the speculative agents‟ role may be an important factor on influencing the short-term behaviour of the market. Further, it was found that the role of fundamentals is either insignificant or is tending to be so in recent years. The problems of policy inconsistency and the so-called „good news‟ and „bad news‟ effects seem to be playing a more dynamic role in the exchange market behaviour today. From the current macro approaches it is seen that these consider only fundamentals such as relative income, relative prices, interest rate differentials, relative cumulated current account balances, etc. But in practice, the market participants (dealers) do not consider only the macroeconomic fundamentals. Particularly in the short run, where transactions tend to occur in a very short time span, it may be easily understandable that practitioners do not consider these macro variables at the moment of forming their expectations. Question that remains is that, in the short run, what are the factors that affect the dealers‟ decision-making? In the literature it was found that more than macroeconomic fundamentals, the dealers consider other variables that are micro in nature (Lyons, 1995). The micro variables are bidask spreads, trading volume, own volatility, non synchronous trading, information (both private and public), inventory cost, etc. The short run fluctuation of macroeconomic variable is quite low. In long run over a quite large span of time, it has some effect, but in the short run they cannot explain the movements of exchange rate. Although there is a dichotomy between the macroeconomic fundamentals and microstructure variables, it is imaginable that there are scopes for the convergence of these two approaches. Currently they are largely separated but over the time this distance will fade away (Lyons, 2001). To continue analysis of the above-mentioned convergence process, the microstructure literature needs to be widely understood. In this spirit the following existing literature review is presented. Market microstructure theory is defined as the study of the process and outcomes of exchanging assets (i.e., currency, stock, etc.) under explicit trading rules (O‟Hara, 1995). While much of economics abstracts from the mechanics of trading, the microstructure theory analyses the way in which specific trading mechanisms affect the price formation process in the financial markets. These trading mechanisms may differ from one market to the other. For example, in the stock market, trading is centralized and synchronous, but in the foreign exchange market trading is decentralized and non-synchronous. However, irrespective of the type of trading mechanism, prices emerge for the assets when buyers and sellers interact. But the question is whether the equilibrium price that emerges is based purely on the interaction of only demand and supply factors that emanate from the desires of the trading agents, as microeconomic theory explains? This enquiry forms the beginning of the study of the microstructure theory. Microstructure theory consists of two models namely the inventory model and the information model. The crux of the inventory model is the problem of optimization as the dealers‟ objective is to maximize expected profit per unit of time. The model emphasizes control of the inventory fluctuations through price adjustments to avoid bankruptcy and failure at the end of dealing. This model also explains the relationship between the transaction cost and the bid-ask spreads. Information models, which are based on the adverse selection problems, explain the behaviour of market prices through the information contents of the traders. Since there asymmetries of information between the dealers exist, their behaviour in making the quote will be different. These information models also explain how the equilibrium market price emerges in the presence of asymmetric information. In microstructure theory, there are two variables that occupy the centre stage, neither of which has any role in the macro approach. These variables are: (a) order flow, (b) bid-ask spread. Both these variables are synonymous with the „quantity‟ and „price‟ in traditional microeconomics. Order flow, as used in microstructure theory, is a variant of a key term in microeconomics, namely, „effective demand‟. It measures the net buyer-initiated orders and seller-initiated orders. Here the word „initiated‟ is very important in differentiating between order flow and the effective demand. In microstructure theory, orders are initiated against a dealer. The dealer stands ready to absorb imbalances between buyers and sellers. There are many difficulties in modelling the bid-ask spread, because the institutional details must be considered. Finance theory identifies three main determinants of the bid-ask spread: the cost of dealer services, the cost of adverse selection and the cost of holding the inventory. The cost of dealer services has been analyzed formally by Demsetz (1968), who assumes the existence of some fixed costs of „predictable immediacy‟ as the service for which the compensation is required by the market makers. These costs may include the cost for acquiring expertise in, and subscription to specialized electronic information and trading systems (e.g. Reuters). Inventory holding costs are also a determinant of bid-ask spreads. Holding inventory of foreign exchange may be risky, because the holder is exposed to the market movements in the value of the inventory. Thus, the difference between the bid and ask prices and a theoretical price somewhere in between may be regarded as a premium required by the inventory holder as compensation for risk. Following the above concepts, micro-macro division may be analysed now. The core distinction between the microstructure approach and the asset approach is the role of trades. Under the asset approach, trades play no role, whereas in microstructure models they are the driving force. We can frame this distinction by considering structural models within these two approaches with the help the flowchart that is presented below (see Figure 1).

Figure 1. Exchange rate determination

The equations of exchange rate determination within the asset approach are typically estimated at the monthly frequency, or lower, as the adjustment between the variables would take a time lag of one month or more and also due to the availability of some of the exogenous variables in this approach. The estimable equation (1) would be of the form:![]()

Where Et is the nominal exchange rate over the period and (i, m) are macro variables such as interest rate and money supply in the economy and other macro variables. Here, changes in public information variables drive price without any role for order flow or spreads. If any price effect from order flow should arise they would be subsumed in the residual εt. Then it estimates the influence of micro variables through a regression model (2). ![]() Where now Et is the change in the nominal exchange rate between the two transactions. The driving variables in the function include order flow (Q) signed so as to indicate direction, a measure of dealer net positions, or inventory (I), and other micro determinants. Here, Ut would capture the effects of macro variables like output, interest rates, etc. To establish the relative importance of the micro and macro approaches, the study estimates the following equation (3) with components from both approaches. Where Et is the change in the nominal exchange rate between the two transactions and Vt is the error term in the equation which will capture unanticipated disturbances.

Where now Et is the change in the nominal exchange rate between the two transactions. The driving variables in the function include order flow (Q) signed so as to indicate direction, a measure of dealer net positions, or inventory (I), and other micro determinants. Here, Ut would capture the effects of macro variables like output, interest rates, etc. To establish the relative importance of the micro and macro approaches, the study estimates the following equation (3) with components from both approaches. Where Et is the change in the nominal exchange rate between the two transactions and Vt is the error term in the equation which will capture unanticipated disturbances.![]() Given this theoretical background, the present study examines the effect of micro (order flow and number of transactions) and macro (daily domestic interest rates) variables on INR/USD exchange rate behaviour with the help of high frequency data (Reuters screen) for months of January and February, 2008, which consists of 39 working days. With the introduction of economic reforms, particularly in the financial sector and foreign investment, volatility in exchange rates may be more intense especially due to the opening up of markets, increasing business of multinational enterprises, increasing foreign institutional investments, and full convertibility on the current account. Now that there is talk of full convertibility on capital account also, it is very important to understand the exchange rate dynamics. (In the Indian foreign exchange market, the daily transactions amount to more than one billion US dollar). So in this current age of US recession, the regular market stabilizing policies carried out by the Federal Reserve Board (Fed) after the subprime crisis forced to change the interest rate and exchange rate policies of different developed and developing countries. So in India RBI being in the apex of monetary system plays a very crucial role by announcing different stabilization policies focusing on managed exchange rate and interest stabilization. Due to the existence of Impossible Trinity, any type of announcement of Central Bank changes speculations of the dealers about the volatility and the arbitrage opportunity in the foreign exchange market. So the study incorporates the role of Central Bank forming a dummy variable model and taking this intercept dummy as a proxy of information regarding the news of announcement of Central Bank.

Given this theoretical background, the present study examines the effect of micro (order flow and number of transactions) and macro (daily domestic interest rates) variables on INR/USD exchange rate behaviour with the help of high frequency data (Reuters screen) for months of January and February, 2008, which consists of 39 working days. With the introduction of economic reforms, particularly in the financial sector and foreign investment, volatility in exchange rates may be more intense especially due to the opening up of markets, increasing business of multinational enterprises, increasing foreign institutional investments, and full convertibility on the current account. Now that there is talk of full convertibility on capital account also, it is very important to understand the exchange rate dynamics. (In the Indian foreign exchange market, the daily transactions amount to more than one billion US dollar). So in this current age of US recession, the regular market stabilizing policies carried out by the Federal Reserve Board (Fed) after the subprime crisis forced to change the interest rate and exchange rate policies of different developed and developing countries. So in India RBI being in the apex of monetary system plays a very crucial role by announcing different stabilization policies focusing on managed exchange rate and interest stabilization. Due to the existence of Impossible Trinity, any type of announcement of Central Bank changes speculations of the dealers about the volatility and the arbitrage opportunity in the foreign exchange market. So the study incorporates the role of Central Bank forming a dummy variable model and taking this intercept dummy as a proxy of information regarding the news of announcement of Central Bank.

In this paper the dummy is defined as follows (4): ![]() Where D1 is an intercept dummy capturing the effect of announcement of policy by Central Bank. D1 is defined as:

Where D1 is an intercept dummy capturing the effect of announcement of policy by Central Bank. D1 is defined as:

D1= 1 after the announcement

D1= 0 before the announcement

With the existing microstructure theory along with the regression models this paper tries to explain the short run exchange rate volatility in Indian foreign exchange market. Before presenting the empirical results based on the secondary data, a brief discussion about previous empirical studies on microstructure theory is given in the following section.

Overview of previous studies on microstructure theory

Until recently, the application of market microstructure theory was limited to the security markets. Its application to the foreign exchange market has begun only in the early 90s, particularly after the introduction of trading systems like the Reuters and Telerates through which the market participants, mostly banks, can complete their transactions electronically in a short time span. These systems made the transactions very easy and reduced the time and transaction costs in the market. This also made available the high frequency data on exchange rates, which helped the researchers in this area to study the market behaviour in the short run and also to forecast it in the short-run. One of the basic studies in this area is that of Goodhart and Figliuoli (1991). In this study, for the first time, high frequency data on exchange rates has been analyzed and many issues have been raised for further research. However, the application of microstructure theory to exchange rates was initiated by a pioneering study by Lyons (1995). While there are few studies that applied microstructure theory these are however restricted to the leading currencies like the US dollar, Deutsche mark and Japanese yen. These studies are briefly discussed in this section. As mentioned in the preceding section, the models based on microstructure theory (particularly the information models) are very useful in explaining changes in the exchange rate movements. Under information models there are two types of studies that exist in the literature: one that concentrates on the public information, which is uniformly available to all participants in the market and its impact on the exchange rates in the short-run; second, the presence of private (and/or asymmetric) information, which is available to individual participants, and its impact on the volume and the rate changes. Researchers explored both the cases with the help of high frequency data and with advanced econometric tools. But there are not many studies that applied the inventory models and this is due to an unavailability of information relating to the order book of the dealers in the foreign exchange market. Below, some of the existing empirical studies are briefly reviewed. Among the variables specified „information‟ has drawn the attention of the most researchers and it has been tested extensively. Bollerslev and Domowitz (1993) studied the intraday-trading activity in a foreign exchange market by considering the „quote arrivals‟ and „bidask spreads‟ recorded for Deutsche mark / US dollar exchange rate data. The study examines the volatility, news effects and the impact of market activity on the returns. It is found that the intensity of quote arrival, which is taken as a proxy for the volume of transactions, has a negative but economically and statistically negligible effect on conditional volatility. New arrivals in the form of number of transactions have no effect on the conditional variance. Information in the form of lagged spread provides a powerful positive and strongly statistically significant effect on the conditional variance. It was found that the bid-ask spreads exhibit a non-stationary process. Changes in the spread are highly negatively serially correlated, with an unconditional mean of zero. The study strongly rejects the restriction that trading activity does not affect the conditional mean and variance of the spread. But it is found that variances in trading activity have a highly statistically negligible effect on the conditional mean. Lyons (1995) examines the micro structural hypotheses in the case of the Deutsche mark / US dollar exchange market by using the data of indicative quotes that are the input in Reuters by a trading bank, for a period of five trading days. The data consists of three components. These are: (1) time-stamped quotes, prices, and quantities for all the direct inter-dealer transactions of a single Deutsche mark / US dollar dealer at a major New York bank; (2) the same dealer‟s position cards, which include all indirect (brokered) trades; and (3) time-stamped prices and quantities for transactions mediated by one of the major New York brokers in the same market. By using the multiple regression model, the study estimates both the models in the microstructure literature, i.e., inventory model and information model. The study finds that order flow affects prices through both the information and inventory channel. Between both the results, the study found that the result for the inventory channel is more novel, i.e., it induces more than 75% for every $10 million of net positions. Ito et. al. (1998) probe the presence of private information among the participants in the Tokyo foreign exchange market, which was closed for trading over the lunch break. On December 22, 1994, this restriction was removed. And this deregulation provides new insights into why return volatility is so much higher during trading hours. The paper examines a wide range of micro structural hypothesis. By using the spot rates of Japanese yen / US dollar and Deutsche mark / US dollar, the study concludes that there is strong evidence that lunch volatility increases with the opening of the trade. The lunch period trade demonstrated flattening the volatility U-shape as the result shows that lunch variance is substantially lesser than both morning and afternoon variance in the closed sample. But lunch variance rises relative to both morning and afternoon variance after the trade opens in the lunchtime. About the results for the third hypothesis, it is supported by the data. It was found that the pronounced variance increases in the hour preceding the lunch break. Once the lunch hour trade opens, this peak variance vanishes and the familiar full day U-shape appears. In the case of fourth hypothesis, it is found that the morning variance actually falls slightly after the opening lunch-hour trade. The afternoon variance clearly rises after opening lunch-hour trade. This change is consistent with information whose private value is short-lived. For the last hypothesis, it is found that US dollar / Deutsche mark volatility over lunch also rises significantly, but by less than the Japanese yen / US dollar. Thus, the study concludes that there exists private information in the foreign exchange market, which is against the common view on the subject. In the spirit of the Ito et. al. (1998) study, Torben and Bollerslev (1998) re-examine the presence of private information in the Japan foreign exchange market. With the help of new procedures they found that the volatility increases during the Tokyo lunch period dealing following the lifting of the trading restrictions. But this research rejects all other conclusions that are derived by Ito et al. (1998) when longer pre-and post-December 22, 1994 data are used. Goodhart et. al. (1995) have tested the working of Reuters D2000-2 time stamped data on one day in 1993. They have collected the half hourly frequency data on Deutsche mark / US dollar. They have studied the interrelations and determinants of the variables that can be extracted from D2000-2: for example event, price and size of deal, and whether an order exhausts the prior quote, the frequency of entry, price, size and volatility of prices for both the bid and the ask; and the spread between them. They have found that the lag variables of bid-ask spread are highly significant and show that the errors are negatively auto correlated. The variance, skewness and kurtosis results of bid-ask spread show the efficiency of the market. In a developed country the variance of spread is very low. In a market with huge turnover and large number of daily quotes the spread is low. Studies of interaction between the many variables available from D2000-2 suggest a close interrelation between quote frequency and between quote (price) changes and the spread (two way causality). These two nexuses are linked, in that a deal that exhausts the amount offered at a previously quoted price will cause a price change both directly and indirectly via its effect on the spread (both directly and again indirectly by raising volatility). Demos and Goodhart (1996) tested the interaction between the frequency of market quotations, spreads and volatility in the foreign exchange market. They have used a simultaneous model with intercept dummy taking care of effect of „information‟ and estimated the model expressed in Box-Cox transformation with the help of ARCH-GARCH method. They have assessed the behaviour of the spot foreign exchange market quotations in terms of volatility, average spread and the number of quotations within half-hour intervals, as well as certain informational aspects of these processes. A new variable was introduced: the number of observations within a specific time interval. This variable plays an important role in the determination of volatility and average spread, either directly or through error terms the contemporaneous correlation of the number of quotations and volatility leads us to hypothesis that the former process could be a proxy for the volume of trade, or for the number of transactions in the spot Forex market, for which data are unavailable. This is in line with the studies in stock market volume and volatility data (Gallant et al., 1992).

Results of the study

Taking the cue from the above studies, the paper analyzes the short run exchange rate movement in the line of microstructure theory using the Reuters D2000-2 data in the Indian foreign exchange market.

Objective of the study In its Report on Currency & Finance 1999-2000 (2001), RBI gave emphasis on the issue of studying the foreign exchange behaviour in a market microstructure framework. The apex bank has indicated that the movements in the macro fundamentals may not back exchange rate movement in India in all time horizons. In this context, the present study analyzes the factors behind changes in the exchange rate in the short run. The specific objectives of the present study would be as follows:

- To test the importance of macroeconomic fundamentals in different time horizons by using secondary data.

- To examine the importance of micro structural factors in the short-term rate movement.

- To analyze the effects of speculation and Central Bank intervention on the rate movement.

Database of the study

For analysis with secondary data the study uses the high frequency data on Indian rupee / US dollar exchange rate that appeared on the Reuters‟ screen and taken from by Bloomberg terminal of Bloomberg‟s website. The high-frequency data cover 39 working days for the months of January and February 2008 with the number of observations being 2000. For daily interest rates, we have taken daily call money rates that are provided by the RBI „Monthly Bulletins‟. For the order flow, since the volume of transactions is not available, daily foreign currency turnover in the interbank spot market, which is also available from the „Monthly Bulletin‟ is taken. Further, number of quotes in a day as one of the microstructure variable is taken in regression analysis and this has been calculated from high frequency data (Microstructure, 1999).

Empirical results based on secondary data

Before analyzing the regression results, the descriptive statistics of the high frequency data used in the study are presented.

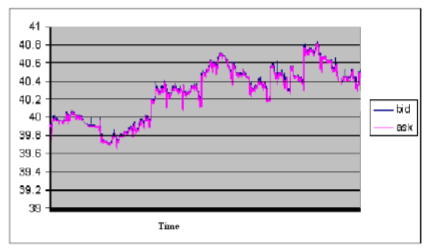

Figure 2. Variation of bid-ask (Bloomberg, 2008)

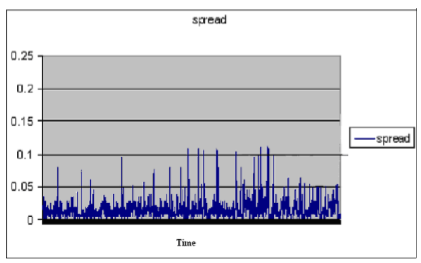

Both the bid and ask prices are plotted in Figure 2 and the bid-ask spreads are plotted in Figure 3.

Figure 3. Spreads (Bloomberg, 2008)

Figure 3. Spreads (Bloomberg, 2008)

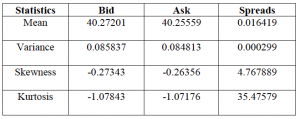

The summary statistics are presented in Table 1. Table 1. Summary statistics for high frequency data INR/US dollar exchange rate (for 1/1/2008-29/2/2008, N=2000) (Bloomberg, 2008)

Table 1. Summary statistics for high frequency data INR/US dollar exchange rate (for 1/1/2008-29/2/2008, N=2000) (Bloomberg, 2008)

It may be found from the summary statistics that the average bid-ask spread, which is widely accepted as a proxy for the transaction cost, in INR/USD is very high compared to other markets. This indicates that the INR/USD market is not very „thin‟ and that the volumes are low in this market (In the case of Japanese and the Euro foreign exchange markets, the average spreads are 0.0001). It is established in the finance literature that the spreads and volumes are strongly negatively correlated. The coefficient of kurtosis is very high in INR/USD market, indicating that INR/USD market‟s spreads are not in tune with the „true‟ or „fundamental‟ market values. The participants in this market may be termed as „defensive players‟ given the high spreads. From the graph on bid-ask spreads of INR/USD, we can see the high variation in the spreads as the graph shows many „pillars‟ indicating defensiveness and low volumes of the INR/USD dealings. To establish the importance of macroeconomic fundamentals and the micro structural variables on the exchange rate movement, several regressions with different specifications are estimated. The results are presented in Table 2 and would be analyzed in the following sub-sections.

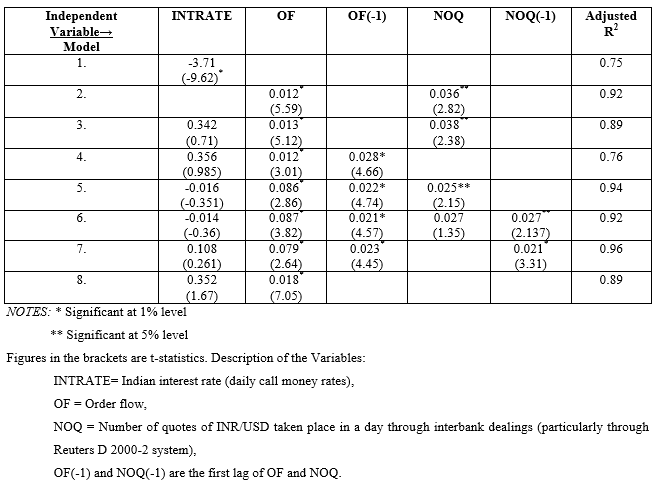

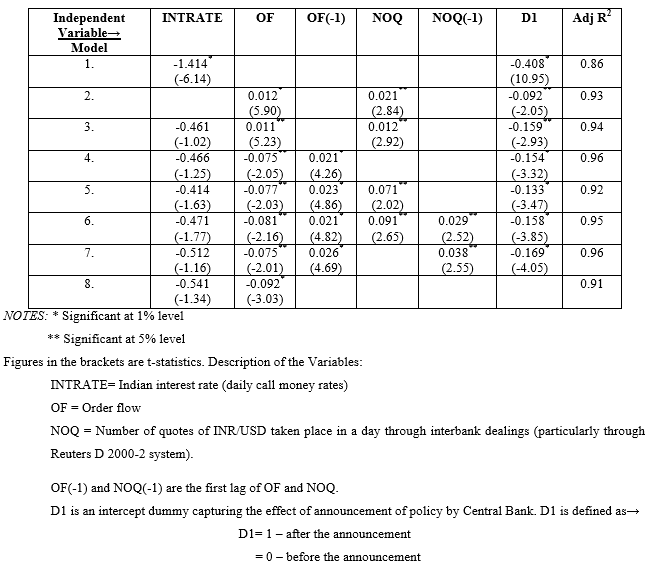

Table 2. Regression results. Dependent variable = Exchange rate (INR/USD) (Bloomberg, 2008; RBI Bulletin, 2008)

With the help of above regression results the relative importance of both macro and micro variables is discussed below in the context of explaining short run volatility of foreign exchange rate in Indian foreign exchange market.

Relative importance of macro and micro structural factors in the short-term rate movement This study examines the relative importance of micro variables (daily order flow in the market) in explaining the short run movements of exchange rate over the macro variables. Since the information on buyer-initiated trades and seller-initiated trades are not published, the present study considers the daily turnover of foreign currency (in million USD) in the Indian foreign exchange market. The study also considers the number of transactions in the market taking the view (Microstructure, 1999) that the number of transactions will be the most important variable in predicting the short-term changes in the asset market prices. For macro variables, the study considers the Indian daily call money rates. In Table 2, only the specifications that have high explanatory power (in terms of adjusted-R2) are presented. A one period time lag is also used to capture the „left out effect‟, which is usual in the financial markets. From the Table 2 it may be noted that in the first model, where only domestic interest rate is included in the equation, interest rate found to be highly significant. In the second model, this paper estimates exchange rate only on micro structural variables (namely turnover and number of transactions) and found that both the variables turned out to be positive and highly significant. These results show that independently both fundamentals and micro variables seem to have a significant impact on the daily rates. To establish the relative importance of macro and micro variables, this paper includes both in the estimation equations and estimates this with different combinations. It can be seen, when the exchange rate is regressed on interest rates, turnover and the number of transactions, both the micro variables turned out to be highly significant. But interest rate turned out to be insignificant. In all the other combinations also, the interest rate turned out to be insignificant, whereas the micro variables have a significant impact on the exchange rate. The study supports the findings of Evans and Lyons (2002). This result supports the disclaimers of macro theories on exchange rate determination models. But it also does not support the findings of Meese and Rogoff (1983) that exchange rates follow a random walk process. There are some factors that explain the exchange rate movement that are micro in nature.

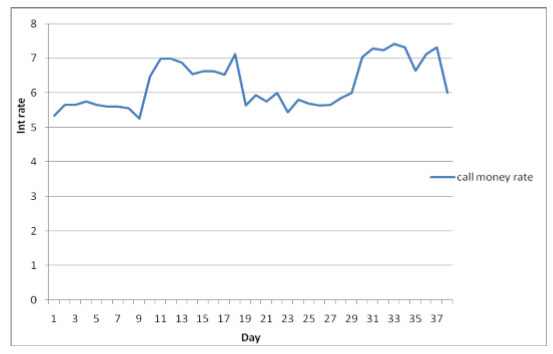

Central Bank intervention and its effect on the foreign exchange market Ghosh (2002) has tested the long run impact of Central Bank intervention on Indian foreign exchange market with the help of daily data of nine months in 1998. That paper analyzes the long term effect of Central Bank intervention with the help of Tobit and Logit model. It is known from the existing literature that the speculation and Central Bank intervention has significant impact on daily fluctuation of exchange rate. In long run the policy announcement and the new policy implementation has impact on the movement of exchange rate and hence it causes change in bid-ask spreads. Specially, the announcement of RBI causes regular change in order flow; it changes the volume of trade, number of quotations in the foreign exchange market. In this paper, a regression model is used with an intercept dummy variable to explore the effect of announcement of Central Bank on the volatility of exchange rate. This intercept dummy captures the effect of any type of policy declaration and information regarding the macro variables. In the month of January this year US Fed has cut the interest rate by 50 basis point in order to control the recessionary pressure mainly caused by the subprime crisis. As a response to the debate whether the RBI should follow Fed or not, RBI Governor Dr. Y.V. Reddy declared on January 29, 2008 in a press release, that India will not follow the Fed or all the key interest rates will remain unchanged. The cash reserve ratio stays same and the cash reserve ratio (CRR) repo and reverse repo rates as well as the bank rates will remain unchanged. The policy will leave flexibility to change repo and reverse rates in the near future. The reverse repo rate stays at 6% and CRR at 7.5%. The inflation target for year 2007 – 2008 also remains at 4 to 4.5% levels and 3% in medium term. In the month of February, 2009 Central Bank has intervened in the market to control the liquidity. RBI supported the market through repo injections and improved liquidity situation, the call rates eased and then slipped further to 4.82% on February 29, 2008 as there was no demand pressures from the banks for covering their reserve positions. The dummy variable of intervention is introduced as „announcement‟ made on January 29, 2008 and the after effects. So the dummy is defined in the following way: before the announcement as „zero‟ values, and after the announcement as „one‟ values. From Table 3, it can be seen when the macro variable and the dummy is in the model, then both the variables are significant (with adjusted R2=0.86). However with different other combinations introducing the micro variables, there is higher adjusted R2, showing greater explanatory power of the model. In other words, the intercept dummy explains the short run volatility in a greater manner. The co-efficient of dummy variable is significant in all other combinations of regressions showing impact of announcement in the foreign exchange market in short run. But as a result of this announcement, we can see greater fluctuations in the spread after the January 29 giving higher inefficiency in the market (see Figure 2 and Figure 3). So the announcement has certain impact on the demand and it reduces the fluctuations in exchange rate over time and targeted exchange rate can be delivered at the cost of higher inefficiency in the foreign exchange market. Empirical result supports the survey of dealers by Bhanumurthy (2000) where the dealers feel that the Central Bank intervention reduces the speculation and they feel without speculation the turnover in the market is less and the volume of trade is also low. Thus, according to the dealers, the intervention may „bring orderly movements‟ but overall these intervention activities are „depressing‟. But the empirical study shows that over the period the market very quickly assimilates this effect of macroeconomic announcements (see Figure 4) and market try to reach a new equilibrium position with the help of macro variables.

The co-efficient of dummy variable is significant in all other combinations of regressions showing impact of announcement in the foreign exchange market in short run. But as a result of this announcement, we can see greater fluctuations in the spread after the January 29 giving higher inefficiency in the market (see Figure 2 and Figure 3). So the announcement has certain impact on the demand and it reduces the fluctuations in exchange rate over time and targeted exchange rate can be delivered at the cost of higher inefficiency in the foreign exchange market. Empirical result supports the survey of dealers by Bhanumurthy (2000) where the dealers feel that the Central Bank intervention reduces the speculation and they feel without speculation the turnover in the market is less and the volume of trade is also low. Thus, according to the dealers, the intervention may „bring orderly movements‟ but overall these intervention activities are „depressing‟. But the empirical study shows that over the period the market very quickly assimilates this effect of macroeconomic announcements (see Figure 4) and market try to reach a new equilibrium position with the help of macro variables.

Figure 4. Daily call money rate (RBI bulletin, 2008)

Figure 4. Daily call money rate (RBI bulletin, 2008)

The greater volatility of spread in the market can be explained with theoretical explanations such as Bhattacharya and Weller (1997) and Vitale (1997) which suggest that the market reaction to a Central Bank intervention depends on the degree of heterogeneity across trader beliefs about the fundamentals as well as the intervention signal. An increase in the incongruence between prior beliefs about the fundamentals and the intervention signal lead to spot rate volatility increases following intervention episodes. Additionally, the link between the volatility of an asset and the spread on the asset is well-known in the market microstructure literature and implies that increased volatility leads to more adverse selection and greater inventory risk. The variability of the spot rate is directly related to the precision with which traders‟ interpret the intervention signal. If an intervention announcement creates uncertainty about future monetary policy or other fundamentals and hence the future spot rate, bid-ask spreads should widen. However, if the Central Bank can credibly transmit a signal to the market designed to reduce uncertainty about the short-run variability about the target exchange rate, we should witness a narrowing of spreads. This prediction suggests that traders‟ signals about the fundamentals can be combined with their interpretation of the signal conveyed by Central Bank intervention to determine price responses in the inter-bank market for foreign exchange. As the RBI „s announcement credibly conveys its direction towards inflation targeting and further repo injection mechanism in the market to control the problem of excess liquidity, the variability of spreads decreases with time (see Figure 3). Thus, empirical results of this paper support the explanations of information model of market microstructure theory.

Conclusions

The present study discerns the factors that affect the exchange rate movements in the short run from a secondary data analysis. This study focuses on the relative importance micro variables over macro variables in the aspect of explaining short run exchange rate movements. For this purpose the evidences of market microstructure theory in the Indian foreign exchange market were checked. From the high frequency data analysis (Reuters‟D 2000-2) this paper shows that the Indian foreign exchange market is not efficient in comparison with the developed countries. This paper also shows that the micro variables such as order flow, bid-ask spreads can explain the short run movements of exchange rate with a greater success in comparison with macro variables. The announcement of Central Bank in short run shows significant impact on exchange rate movements but a reduction in volatility of exchange rate over time comes with greater market inefficiency giving rise to volatility in spreads. But as the information asymmetry decreases over time and the effect of intervention is assimilated in the market, the volatility of spreads decreases over time. This raises a question of credibility of policy announcement of Central Bank. The results of this paper support the theoretical exposition of existing literature that a credible policy announcement reduces the volatility of spreads over time as the beliefs of traders are revised and it comes in tune with the policy announcement of macro fundamentals. The final area of future works concerns about a deeper study of effect of micro variables on the short run movements in Indian foreign exchange market taking more micro variables as explanatory variables. The bid-ask data show a tendency of negative autocorrelation and the modelling should try to capture time series analysis with ARCH and GARCH models. The role of announcement of Central Bank and the volatility of spreads should have more theoretical background to explain the causality of variation between them. This leaves a huge scope of research work in the context of Indian foreign exchange market as it captures the role of expectations of traders in the foreign exchange market. According to the microstructure theory, the institutional features of foreign exchange market show that it is decentralized and there is lack of transparency. Therefore, further research work with high frequency data can show the effect of information asymmetry among the traders after the intervention of Central Bank. The rate of assimilation of the news or the reduction of volatility of spreads after the announcement can show the degree of centralization of the foreign exchange market and it can show the reduction of inventory risk in the market.

References

- Bhanumurthy N. R. (2000) Information effects in Indian foreign exchange market. Conference volume, Fourth Capital Markets Conference, UTI Institute of Capital Markets, Mumbai.

- Bhattacharya U., Weller P. (1997) The Advantage to Hiding One‟s Hand: Speculation and Central Bank Intervention in the Foreign Exchange Market. Journal of Monetary Economics, Vol. 39, Issue 2, pp. 251-277.

- Bloomberg (2008) Bloomberg-Intraday 10min hi-frequency data for period 1/1/2008-29/2/2008.

- Bollerslev T., Domowitz I. (1993) Trading Patterns and Prices in the Interbank Foreign Exchange Market. Journal of Finance, Vol. 48, Issue 4, pp.1421-1443.

- Demos A. A., Goodhart C. A. E. (1996). The interaction between the frequency of market quotations, spread and volatility in the foreign exchange market. Applied Economics, Vol. 28, Issue 3, pp. 377-386.

- Demsetz H. (1968) The Cost of Transacting. Quarterly Journal of Economics, Vol. 82, No.1, pp. 33-53.

- Evans M. D. D., Lyons R. K. (2002) Order flow and exchange rate dynamics. Journal of Political Economy, Vol. 110, Issue 1 (Feb), pp.170-180.

- Gallant A. R., Rossi P. E., Tauchen, G. (1992) Stock Prices and Volume. Review of Financial Studies, Vol. 5, No. 2, pp. 199-242.

- Ghosh S. K. (2002) RBI Intervention in the Forex Market: Results from a Tobit & Logit Model Using Daily Data. Economic and Political Weekly, June 15, pp.2333-2348.

- Goodhart C. A. E., Figliuoli L. (1991) Every Minute Counts in Financial Markets. Journal of International Money and Finance, Vol. 10, Issue 1, pp. 23-52.

- Goodhart C. A. E., Ito T., Payne R. (1995) One Day in June 1993: A study of the working of the Reuters 2000-2 Electronic Foreign Exchange Trading System. The Microstructure of Foreign Exchange Markets, Chicago: University of Chicago Press.

- Ito T., Lyons R. K, Melvin M. T. (1998) Is There Private Information in the FX Market? The Tokyo Experiment. Journal of Finance, Vol. 53, Issue 3, pp.1111-1130.

- Lyons R. K. (1995) Tests of microstructural hypotheses in the foreign exchange market. Journal of Financial Economics, Vol. 39, Issue 2-3, pp. 321-351.

- Lyons R. K. (2001) The Microstructure Approach to Exchange Rates. Cambridge, MA: MIT Press.

- Meese R. A., Rogoff K. (1983) Empirical exchange rate models of the seventies. Do they fit out of sample? Journal of International Economies, Vol. 14, Issue 1-2, pp. 3-24.

- Microstructure (1999) Microstructure: The organization of trading and short-term price behaviour, Vol. I. Edited by Hans R. Stoll.

- O’Hara M. (1995) Market Microstructure Theory, Blackwell Publishers Inc.

- RBI Bulletin (2008) Reserve Bank of India – Bulletin (February 2008). Available online: http://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/83030.pdf.

- Report on Currency & Finance 1999-2000 (2001) Reserve Bank of India publication, Chapter IV, pp.1819. Available online: http://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/18590.pdf.

- Torben A. G., Bollerslev T. (1998) Deutsche Mark-Dollar volatility: Intraday activity patterns, macroeconomic announcements, and longer run dependencies. Journal of Finance, Vol. 53, Issue. 1, pp. 219-265.

- Vitale P. (1997) Sterilized Central Bank Intervention in the Foreign Exchange Market. Working Paper, London School of Economics.