Vashakmadze T. (2008). Calculating equity risk premium for Russian market – an empirical analysis. Global Academic Society Journal: Social Science Insight, Vol. 1, No. 5, pp. 4-15. ISSN 2029-0365. [www.ScholarArticles.net]

Author:

Teimuraz Vashakmadze, Academy of National Economy under the Government of Russian Federation, Russia

Abstract

If we look at equity researchers’ analytical reports in Russia we will see that weighted average cost of capital (WACC) for Russian companies is between 9% and 11%. It might be supposed that these figures are relatively low and are not showing all the risks of Russian companies. In the paper, cost of equity (COE) for the Russian market is calculated using empirical data. For COE calculation, modified capital asset pricing model (CAPM) with country risk premium (CRP) involved is used. For CRP calculation, three approaches are used: default spread, relative equity market standard deviations, and default spread plus relative standard deviations. In the research, two hypotheses are set and proved:

- Equity researchers were trying to give proof of high prices of Russian companies before financial crisis by calculating lower WACC than it was in reality;

- Risks of investing in Russian companies have not declined in spite of pushed up ratings of sovereign Eurobonds of Russia.

Introduction

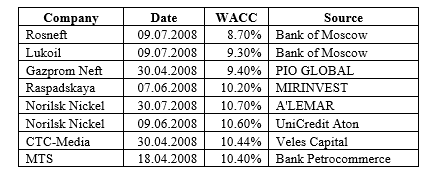

The equity risk premium (ERP) is the incremental return over risk-free assets that investors require to accept the risks associated with owning stocks. The ERP is the key input into estimating cost of equity and hence it is key input in discount cash flow valuation. Knowing its importance in valuation of assets, it is surprising how equity researchers in Russia were calculating weighted average cost of capital (WACC). If we look at equity researchers’ analytical reports in Russia we will see that WACC for Russian companies is between 9% and 11% (these figures were in equity research reports, which were published before August 2008). The Table 1 below shows the short list of Russian companies and WACC calculated by different investment companies. It might be supposed that these figures are relatively low and are not showing all the risks of Russian companies.

Table 1. Historical Equity Risk Premium

This paper calculates ERP, cost of equity and WACC for the Russian market using empirical data and assumptions, which are introduced below.

Research methodology

The paper suggests a better approach to CRP calculation for Russia and tests two hypotheses:

- Equity researchers were trying to give proof of high prices of Russian companies before financial crisis by calculating lower WACC than it was in reality;

- Risks of investing in Russian companies have not declined in spite of pushed up ratings of sovereign Eurobonds of Russia.

For testing above mentioned hypotheses, the methodology described below is used:

- Cost of equity calculation for Russia: for calculating COE for Russia, modified CAPM (appendix #1, equation #1) is used.

- Equity risk premium calculation for the US market: historical risk premium approach is used to calculate ERP for the US market. Historical premium approach looks at history, assesses equity returns in the past, and compares them with risk free returns. The difference between annual returns represents the historical risk premium.

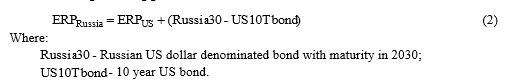

- Russian country risk calculation: for CRP calculation (Damodaran, 2008) three approaches are used: default spread (appendix #1, equation #2), relative equity market standard

Vashakmadze deviations (appendix #1, equation #3), and default spread plus relative standard deviations (appendix #1, equation #4). - Data analysis and hypotheses testing: the results of different CRP calculation approaches are compared, analyzed and the hypotheses are tested by calculation of WACC (appendix #1, equation #5) using different CRP calculation approaches and synthetic cost of debt calculation method (appendix #1, equation #6). Besides, implied premium approach is used for hypotheses testing. Implied premium approach is a forward looking approach where we look at P/E

of the market. From P/E we can find earnings cap rate

(Hitchner 2008), where g is a long-term sustainable growth rate; hence from P/E we can see what cost of equity is in current market prices.

Assumptions

The research is based on the following assumptions:

- Risk free rate equals Tbond yield;

- For historical returns of S&P500 and Tbond calculation, geometric averages are used;

- For historical returns of S&P500 and Tbond calculation, the time period starting from 1928 is taken;

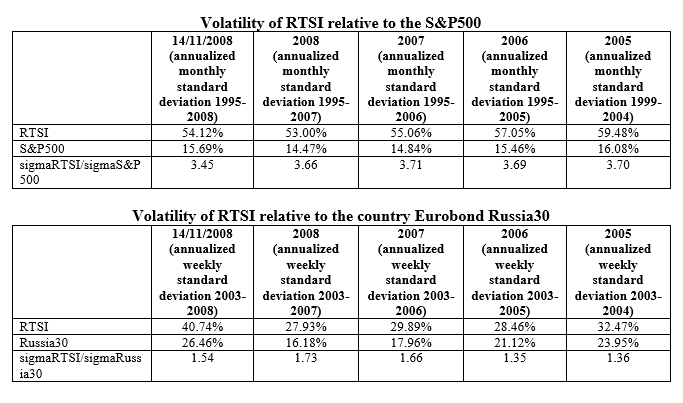

- For relative equity market standard deviations approach, annualized monthly returns of RTSI and S&P500 standard deviations of 1995-2008 are used;

- For default spread + relative standard deviations approach, annualized weekly returns of RTSI and Russia30 standard deviations of 2003-2008 are used;

- Beta of the security equals 1;

- D/E ratio equals 1;

- Tax on profit equals 24%;

- Bank margin equals to 1%.

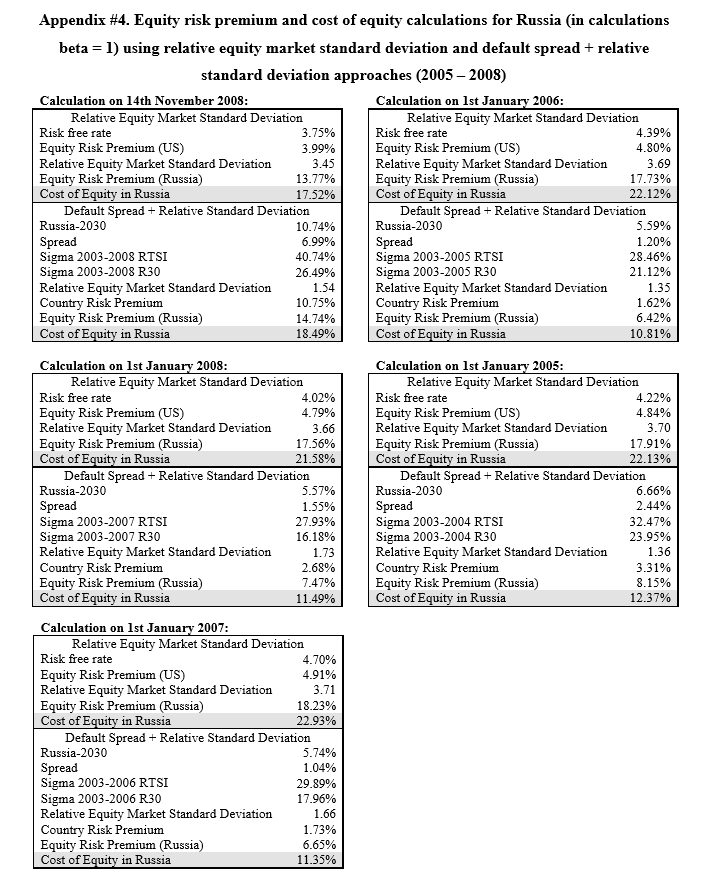

Calculations and data analysis (data as of 14th November 2008):

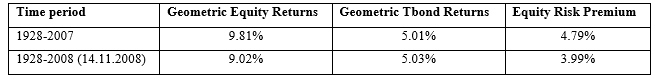

The Table 2 bellow shows that historical equity risk premium in the US dropped from 4.79% to 3.99% because of the financial crisis we are facing today. The data of returns for 1928-2007 were taken from www.damodaran.com and updated on 14.11.2008 using www.finance.yahoo.com and http://www.indexarb.com internet resources. The full data about historical returns of the US market is presented in appendix #2.

Table 2. Historical Equity Risk Premium

Table 2. Historical Equity Risk Premium

Now that ERP for the US market is found, calculation of ERP for the Russian market using 3 approaches is provided below:

Default spread approach is calculated using equation #2 (appendix #1):

Relative equity market standard deviations approach is calculated using equation #3 (appendix #1).

![]()

Default spread + relative standard deviations approach is calculated using equation #4 (appendix #1):

In appendix #3, annualized standard deviations calculations of RTSI, S&P500 and Russia30 are presented.

Using equation #1 (appendix #1) cost of equity for Russia can be calculated.

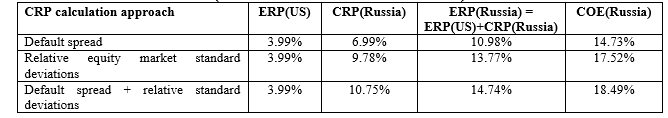

Table 3. Comparison of CRP, ERP and COE for Russia using different approaches (calculations on 14th November 2008)

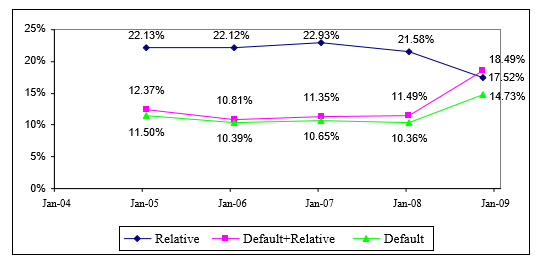

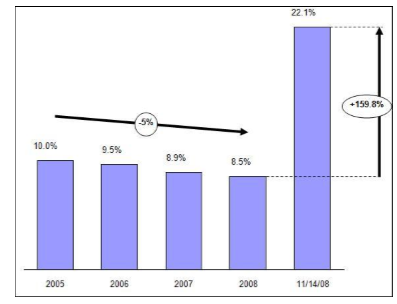

In Table 3, we can see that the maximum cost of equity is calculated by default spread + relative standard deviations approach. But if we look at Figure 1, we can see that from 2005 to 2008 COE calculated by relative equity market standard deviations approach was twice higher on average than COE calculated by default spread based approaches.

Figure 1. COE by years using different approaches

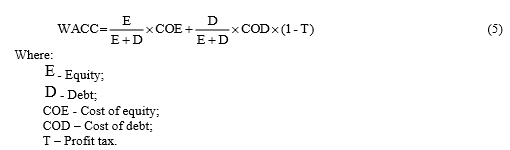

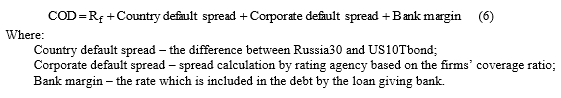

There are two drivers why COE calculated by relative equity market standard deviations approach has dropped, the first driver we discussed already is decreased ERP in the US market because of the financial crisis and the second driver is increased default spread of Russia30 and US10Tbond also because of the financial crisis. If we try to understand why default spread of Russia30 increased during the crisis we can see two main reasons: (a) decrease in commodity prices and (b) capital outflow from Russia and usage of reserves to help the economy. Rising commodity prices pushed up Russian sovereign bond ratings, hence by using default spread related approaches the risks of investing in Russian companies would have been artificially calculated twice as low as in the case of calculating COE by relative equity market standard deviations approach. Hence the hypothesis that risks of investing in Russian companies have not declined in spite of pushed up ratings of sovereign Eurobonds of Russia can be proved. In my opinion, for an emerging country like Russia it is better to use the relative equity market standard deviations approach because it is less affected by commodity prices. Now that COE is found, WACC can be calculated using equations #5 and #6 (appendix #1). For cost of debt calculation, synthetic approach and the given assumptions are used. The calculations show that AAA ranked company at 14th November 2008 equals 12.49%, after tax cost of debt equals 9.49%. The corporate default spread for AAA ranked company is 0.75%. In Table 4 cost of debt and after tax cost of debt by years 2005-2008 are presented.

Table 4. Cost of debt and after tax cost of debt by years

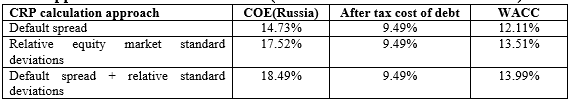

The next step is to calculate WACC for different CRP calculations approach and try to understand whether it was correct for equity researchers to use WACC figures around 9%-11% or analysts were using this figures just to prove the high prices of Russian companies.

Table 5. Comparison of WACC for AAA ranked company in Russia using different approaches of COE calculations (calculations on 14th November 2008) CRP

Table 5. Comparison of WACC for AAA ranked company in Russia using different approaches of COE calculations (calculations on 14th November 2008) CRP

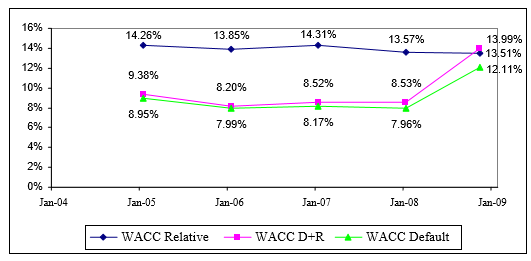

Analyzing data from Table 5 and Figure 2 we can see why equity researchers were using low WACC in the reports: probably they were using default spread approaches, but as it was already mentioned, for Russia it is not correct to use default spread based approaches. This is due to the fact that increasing prices in commodity will reflect as lowering default spread of sovereign bonds and increase in rating of Russia. This however does not mean that risks of investing in Russia are declining when commodity prices are increasing.

Figure 2. WACC by years using different approaches

If we compare Figure 2 with Figure 3, we can see that the default spread based approaches look similar to the implied premium approach. As we know, the implied premium approach shows what COE is in the current market prices. Using the given assumptions WACC for RTSI was calculated. If we look at Figures 2 and 3 more closely we can see that WACC calculated by implied premium approach is higher compared to default spread based approaches. Hence this means that if we were calculating Russian companies target prices using default spread based approaches we would be undervaluing them compared to market prices.

Figure 3. WACC by years using implied premium approach

Figure 3. WACC by years using implied premium approach

The analysis proved the hypothesis that equity researchers were trying to give proof of high prices of Russian companies before financial crisis by calculating lower WACC than it was in reality. We cannot be sure that implied premium approach is showing currently fair cost of equity mainly because of the panic and sell off we are facing now.

Conclusions

The paper has calculated and analyzed CRP calculation using three different approaches and suggested that for an emerging country like Russia it is better to use the relative equity market standard deviations approach. The analysis has shown that rising commodity prices pushed up Russian sovereign bond ratings; and by using default spread based approaches the risks of investing in Russian companies were artificially underestimated. This proved the hypothesis that risks of investing in Russian companies have not declined in spite of the pushed up ratings of sovereign Eurobonds of Russia. The analysis of WACC calculated by three different CRP approaches and WACC calculated using the implied premium approach proved the hypothesis that equity researchers were trying to give proof of high prices of Russian companies before financial crisis by calculating lower WACC than it was in reality.

References

- Damodaran A. (2008) Equity Risk Premiums (ERP): Determinants, Estimation and Implications. pp. 41 – 48. Available at: http://www.damodaran.com.

- IndexArb (2008) Index Insights and Market Timing Tools: Futures, Equities, Options. Available at: http://www.indexarb.com/dividendYieldSortedsp.html.

- Hitchner J. R. (2008) Cost of Capital. Maroseika. p. 20.

- Yahoo! Finance (2008) Available at: http http://finance.yahoo.com/q?s=^TNX.

Appendix #1. List of the equations which are used in the research

- Modified CAPM equation:

- Default spread approach:

- Default spread + relative standard deviations approach:

- WACC calculation:

- Synthetic cost of debt calculation:

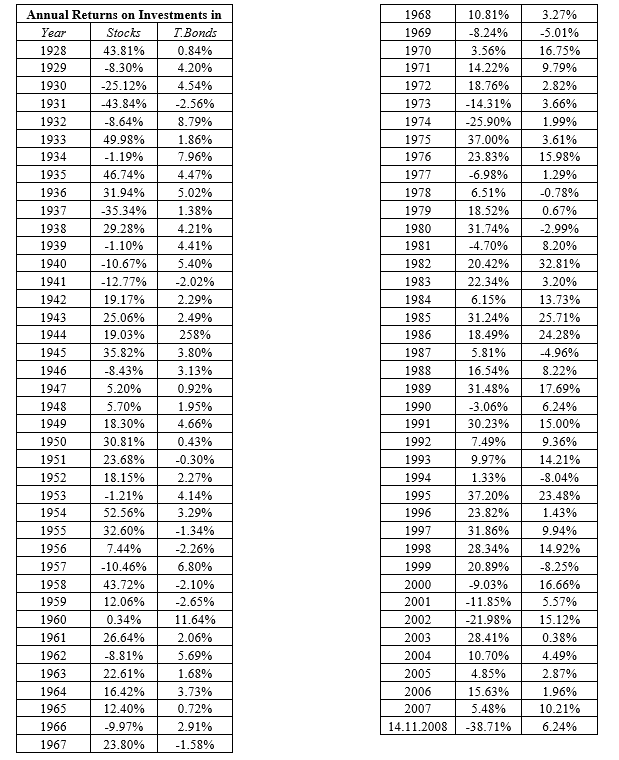

Appendix #2. Historical return on investments in equity and bond markets in the US (Damodaran, 2008)

Appendix #3. Relative equity market standard deviation calculation