Kolosovsky A. (2009). Capitalized economy of Russia: theory and practice. Global Academic Society Journal: Social Science Insight, Vol. 2, No. 8, pp. 4-23. ISSN 2029-0365. [www.ScholarArticles.net]

Author:

dr. Andrei Kolosovsky, Saint Petersburg State University of Service and Economics, Kaliningrad Branch, Russia

Abstract

The present global financial crisis has identified problems of the theory and practice of an economy. One of such problems, from the point of view of the global general capital, is the out-ofdate tradition of representing factors of production that does not reflect a real state of affairs anymore; this harms both: development of economy, and science progress. This problem is evidenced through the overestimation of the role of financial capital and obvious underestimation of the role of human capital in the development of modern economy. This leads to the situation that now the mechanisms that are developed by the global community with the aim to combat financial crisis, monetary instruments dominate over the others. On the other hand, underestimation of human capital from the methodological point of view is fraught of gnoseological problems in the studies of human‟s role in the economy development; meanwhile, from the practical point of view, it leads to loss of labour motivation, depopulation, social tense and other phenomena that take place in modern Russia. Therefore the present article aims to rethink the role and to bring new light on traditional views regarding the resources that are used by mankind to satisfy its needs. The article overviews process of development of global capitalist economy, and its permanent capitalization. The further presented concept of the general capital is based on paradigm of economic society that builds on the theory of generality of a universal capitalist economy. Income from all types of the general capital is interest on capital. The article overviews the structure of the general capital in Russia, and discusses the reasons and consequences of this structure. The author offers mechanism for improving reproduction of human capital in Russia.

Introduction

The present global financial crisis has brought attention to number of practical and theoretical questions. These questions range from those typical only to financial and political sphere (e.g. how to overcome this crisis) to fundamental ones: first of all, what does the modern global economy represent itself? Where is it moving to? And, at last, what changes do adequately describe this event, and mainly, what are the predictions for the future? There are no consistent enough opinions among researchers and experts on problems that occur in economy: starting from the end of a long cycle and, finishing transition to a new type of civilization. The Marxist tradition still exists in Russia. In the majority of Russian authors‟ tutorials on enterprise economy the following (in fact, typical) structure of material presentation is observed (e.g., Volkov and Sklyarenko, 2008). At first, fixed capital as a basis of any business is considered. Then in order of decreasing importance and significance of fixed-capital resource in formation of final product of the enterprise, added cost, working capital, financial, raw and power resources and, at last, manpower are considered. The result of such methodology is that human resource is lastconsidered in the economy of Russian enterprise, as well as in the course of product (service) pricing and formation of prime cost. If it is necessary to limit costs, it is done, as a rule, at the expense of the less significant resource, i.e. human resource. One may tell that it is a tribute to tradition. In author‟s opinion, the reason lies much deeper. Thousands of future Russian specialists of national economy have been brought up and continue to be brought up basing on such approach, which includes quite concrete determination: the underestimated human‟s role in the affairs of the enterprise where he / she works, in the affairs of the settlement where he /she lives, and at last, in the affairs of the region and whole country. Present financial crisis identified extreme vulnerability of hired workers against employers and the state. State policy, focused on low level wages in budgetary sphere, also provides guidance for business “to economize” on labour. As the result of such “rationalization”, the government and businesses get an effect that appears fast, but is actually short-term: prices of Russian production decrease, which stimulates export. On the other hand, low labour costs deprave management and make it ineffective. Apart from that, as a result of globalization, other production costs and turnover equalize. Not only this neutralizes effect brought by minimization of labour remuneration, but also leads to numerous distant negative results, which are discussed below. In fact, such low-paid labour may be neither creative nor qualified; besides, it is very difficult to stimulate it. Worker‟s way of thinking is simple: he works as much, as he / she is being paid. Such work does not create anything worthwhile. Meanwhile, on the other side of the labour market a reverse process occurs: a huge gap between income of workers and income of managers in sphere of business, as well as in public sphere appears. At the same time it is not a secret (in modern Russia, it is boasted to the utmost extent), that this revenue is formed on the basis of the administrative rent. In turn, low income of 70 % of the population does not allow developing financial institutions and funds, which are necessary for creation of financial basis for development of non-governmental civil society institutes. The situation aggravated recently when due to economic slowdown, which replaced rapid economic growth, many workers lost their earnings while they did not have any savings. As a result, internal demand for domestic products and services sharply declined; production fell down too. Thus, a vicious circle can be seen here: fraught “tangle” of micro- and macroeconomic, socio-psychological and other problems, which haven‟t been solved for decades. As a result, lumpenisation of the population occurs on one pole of society and accumulation of fabulous wealth on the other. The evidence allows one to argue, that such situation is intolerable. Therefore, the present article attempts to rethink the role, and to provide a new light on traditional views towards resources that are being used by mankind in order to satisfy its needs. The correctness of any hypotheses is checked by practice and time. If speak to the point, we are witnesses and participants of the process of the global capitalist economy development and transformation. Therefore, we need to consider ongoing economic processes in the context of their permanent capitalization process. If Western society has reached significant heights in this process, Russia and the states of the former Soviet Union only now enter the final stage of capitalization of economy and society. This stage corresponds to establishment of economic society (i.e. city society, capitalistic society) in these countries. What does economic civilization mean? As Osipov (2003) notes, civilization consists of a particular culture, i.e. everything that is created by human: “the material and the ideal, the real and the unreal, the visible and the invisible, the virtual and the embodied…”. This author comes to the conclusion, that any developed economy may exist outside the civilization. “…Civilization is imminent in relation to economy, it is within economy; and therefore economy may be only provisionally analyzed outside the civilization components that have economical nature, but absolutely non-economic functions and participation in the economics” (Osipov, 2003). Moreover, while Nobel Committee only recently has brought due attention to the non-economic aspects within the science of economics and the economists considered this insight as a revelation; philosophy of economics know this for a long time. Further Osipov (2003) highlights that “culture, ideology, religion, morals, psychology, as well as behavior of people, groups and communities and many other things that exist in economic life and define it to much larger extent than a “pure” economist might think, are not completely indifferent” for the philosophy of economy. Here the following question arises: why only now this has happened in Russia? Why only in the 90-ies of the 20th century this country has moved into the economic civilization? Historians of philosophy explain this by the fact, that Russian civilization is much younger than the Western European one. The great economic revolution in Western Europe (in XIV-XVII centuries) has established economic civilization as the quintessence of capitalism, and together with it has led to the technological, political, cultural-ideological, including religious (e.g. rise of Protestantism) revolutions. In other words, total economism (economic society) occurred. “The economy seizes the human being and his life and existence; this way economism declares about itself. Everything around is dependent on and supports the economic principles, everyone enjoys them. Domination of the economic principles is called the “economism” (Osipov, 2003). The economism (as an external force) has driven the Soviet-Russian civilization into the global economic civilization. We eyewitnessed how these processes appeared in the end of the 20th – beginning of the 21st century and how it continues these days: revolution of 1991 and the emergence of huge capital; occurrence of financial institutions and impoverishment of millions of people. As Osipov (2003) further notes, the difference here is that “…our revolution was going in the context of highly-developed economic civilisation: namely under its influence and at its presence; therefore in Russia, not birth of economic civilisation, but rather inclusion into it took place – even though at the level of poor periphery”.

Model of general capital structure

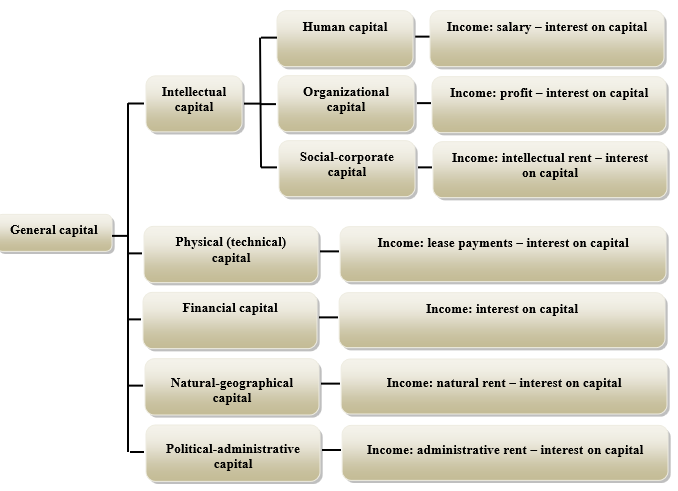

In author‟s opinion, capitalization process and creation of general global capitalist economy may be methodologically described by applying the concept of general capital (see Figure 1). In order to maintain a standard conceptual device, proposed framework of general capital includes investment income source for each capital factor, for example: wages, natural rent, interest rates, etc. However, income from any form of the capital is interest on the capital. In this sense, all proprietors of various forms of the capital are equalized: in the truly free, democratic society all forms of general capital are completely equal among themselves as they are forms of a single essence, paradigm of the capital. This concept corresponds to the notion of capital in a broad sense as to the assets that bring income flow, which is a fundamental concept used in the Western textbooks on the economic theory (Samuelson and Nordhaus, 1987; Fisher et al., 1990). Becker (1964), who is the classic of modern economic thought, builds on the ideas of human behavior as rational and expedient, using such concepts as “scarcity”, “value”, “alternative costs” etc. to the variety of human life aspects, including those traditionally covered by other disciplines of social sciences. The model formed by this author formed basis for further researches. For the first time the term “social capital” gets wide popularity in 1990, after the publication of American sociologist James Coleman‟s work “Foundations of social theory”. In this work, Coleman (1990) defines social capital as a number of various elements having two major features: “all of them include some aspect of social structure and support certain actions of individuals in the framework of this structure”.

Figure 1. Structure of modern general capital and related income sources

The theory of social capital by Robert Putnam is less controversial and more consequent; in the study on role of civic participation in the work of Italian regional governments, Putnam et al. (1993) have introduced the issue of social capital into the political science. Robert Putnam defines social capital as “elements of social organizations, such as networks, norms and trust, which support interaction and cooperation among its members for mutual benefit” (van Deth, 2000). Intellectual capital consists of reserve and movement of knowledge that is useful for organization. Three components of intellectual capital are as follows:

- Human capital,

- Social-corporate capital,

- Organizational capital.

New knowledge (in the shape of information) is created by intellectual type of human capital with the help of intellectual, investigative and creative work. Here new knowledge acts as a product. Income on this form of capital is called intellectual rent (i.e., remuneration for a scientist, researcher, inventor, innovator as well as creator and seller of information).

a) Human capital is directly linked to various forms of organized activities, or in other words, with forms of process through which capital is transformed into its product (see Figure 1). Productive type of human capital transforms specific knowledge, skills and abilities into the product (in the shape of goods, services, i.e. use-value) through manufacture. Income on this form of capital is labour rent (wage of the hired worker). Human capital as reserve of knowledge, abilities, skills and motivations is available to everyone. By analogy with physical capital, deductions for reproduction of human capital in order to recover efficiency and productivity are product price deductions, in other words, depreciation expenses. These deductions represent expenses for education (including general and vocational), health care, geographical mobility and search for information. However, expanded reproduction of human capital may be achieved at the expense of organization‟s profit.

b) Organizational or structural capital is institutionalized knowledge, which is owned by organization and stored in databases, instructions, etc. In modern world, augmentation and optimal use of human, social and organizational capitals depend primarily on the quality of personnel management.

c) Concept of “social-corporate capital”, or in other words, “micro-social capital”, reflects the nature of relationships between workers, ways and culture of their communication, maturity of interpersonal communication. Social-corporate capital consists of interpersonal communication, relationship of trust, solidarity, readiness for cooperation and support, group- and team-work skills. Social-corporate capital is based on moral attitudes that sometimes are called „moral capital‟. However, social-corporate capital is not confined to moral capital only; it also involves maturity of communication and culture of interaction, together with skills of effective cooperation.

d) Physical (technical) capital is a form of artificial capital, which actually is knowledge, transformed into physical object through work. Fixed assets are products of this type of capital. Income on physical (technical) capital is rent, which takes shape of rental or lease payments to the owner of this type of capital.

e) Financial capital (pure costs) is a form of artificial capital, which represents monetary funds and cash flows, generated through work of finance managers. Products of this type of capital are money and derivative instruments. Income on this form of capital is interest on capital.

f) Natural-geographic capital is capital of natural origin; it is formed through human labour using objects of natural origin. Examples of products of this type of working capital are extracted natural subsoil resources, land used in agriculture, etc. Income on this form of capital is natural (agricultural) rent.

g) Macro-social (political-administrative) capital is a form of artificial social capital, which produce income as well. Products of this type of capital are: political organization of the society, public governance structures. Income on this form of capital is administrative rent. Thus, one may notice that the state as an integral part of modern economy has its own capital, which brings revenue. Therefore, in general the state does not actually need taxes on e.g. human capital, as well as business (organizational capital). In this regard, it is possible and extremely necessary to liberate human capital economically. Further on, this article discusses ways in which this might be done.

The introduced paradigm of general capital corresponds to establishment of completely economized society, where all and everyone possess their own capital; of course, for someone possessing own capital means having talent and abilities (whether a person is an inventor or a cabinetmaker), and for someone it means having own bank or metallurgical plant. Anyway, capital that belongs to a person produces income as an interest on capital if, naturally, there is a demand for a production of this form of capital. If there is no demand for a production of a large factory, the proprietor (-s) of this (physical) capital are in losses, and their stocks are not included in a quotes list on the stock market. In the same way, if a writer – owner of intellectual capital (his own talent) – is well-known and popular author, whose books are bestsellers and quickly bought up by readers, this person is considered a successful capitalist. Highly-skilled cabinetmaker, whose every work is a piece of applied art, is an owner of his growing intellectual capital as well. Gradually becoming obsolete, rental economy has no future in the long term. On one hand, economy management that seeks for rent (i.e. income that covers costs) is caused by necessity to ensure normal functioning of both individual and public economy. On the other hand, aspirations for enrichment and abilities to extract super profit are not typical to all people, but only to those, who are motivated by material wealth, enrichment through subordination of will of other people – these are impulses for passionate (from Latin “passio”– passion) people. These people are talented and inventive in various tricks, and extraordinary steps striving to increase their wealth. This approach within the framework of bourgeois ethics of economic civilization is not only natural, but also is considered to be the driving imperative of modern capitalistic economy. Especially strongly this approach is realized in the field of financial speculations. The current global financial crisis has happened namely in the sphere of fictitious capital. Meanwhile economy, which is based on use of various forms of capital instead of factors of production, where the interest on capital becomes a form of income, fully matches, in the author‟s opinion, the transitional phase of society‟s transformation from economical to posteconomical.

Analysis of the structure of general capital in Russia: reasons and sequences

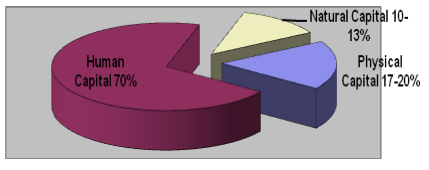

Conceptually outdated approach to assessment of factorial resources and the incomes they generate, leads to a dangerous imbalance related to the initial distribution of resources. For example, in Russia, unlike many other countries, the major contribution to the growth of cumulative net profit is made not by human capital and even not by physical capital, but by natural capital. In other words, it is income from use of land, territory of country, its natural resources, arterial pipelines, communication facilities (transport and modern communication facilities), as well as monopolist position of important manufacturers, whose products have high demand in the market. In year 2001, share of natural capital accounted 75% of the total income. At the same time, contribution of the human capital to the structure of the country‟s total income was 15 times less, while share of physical capital was approximately 4 times less (see Figure 2).

In other words, almost everything that Russia owns today is natural capital related to usage of country‟s potential of natural resource, its land.

Figure 3. Structure of the total income in Russia by the current tax system (Lvov et al., 2001)

Figure 3. Structure of the total income in Russia by the current tax system (Lvov et al., 2001)

As academicians Lvov and Pugachev (2001) pointed out, this is happening because of current distortion of proportions between initial forms of capital in Russian economy. As a result, unreasonably high tax burden on the incomes of business and population is present, which demonstrates an extreme inefficiency of current tax system (see Figure 3). This system oppresses business, constrains the growth of salaries and final demand, artificially increases costs for domestic production, thus reducing its competitiveness, and stimulates reduction of workplaces. We should agree with Lvov and Pugachev (2001) who posit that different tax policy is needed in order to use the natural rent effectively; this policy should only play the role of complementary system for rental payments. This way it would be possible to reduce labour taxation and profit deductions sharply, to retract the VAT, to reduce business deductions for social needs and subsequently to abandon them at all.

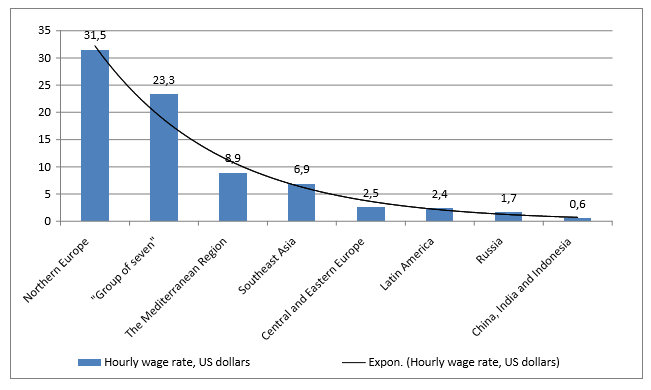

In year 2004, hourly wage rate in Russian industries accounted 1.7 US dollars. In China, India and Indonesia, the hourly rate was 3 times higher; meanwhile in countries of Central and East Europe and Latin America it was 1.4 times less (see Figure 4).

Figure 4. Hourly wage rate in the industries of country groups, US dollars (data as of year 2004) (Nureyev, 2009)

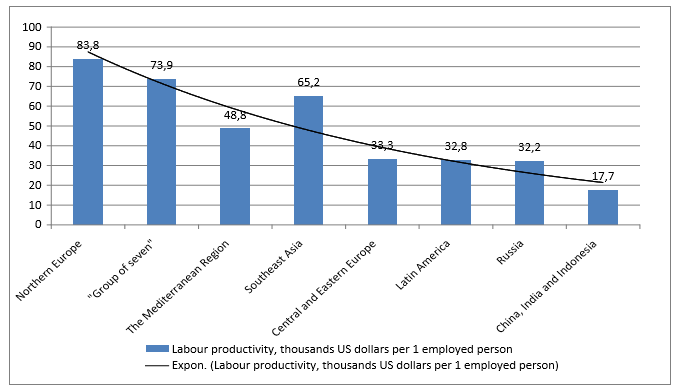

While speaking about labour productivity, in year 2004 Russia was at the same level as countries of Central and Eastern Europe and Latin America (see Figure 5).

Figure 5. Labour productivity in the industries of country groups calculated as added value per 1 employed person, 1000 US dollars (data as of year 2004) (Nureyev, 2009)

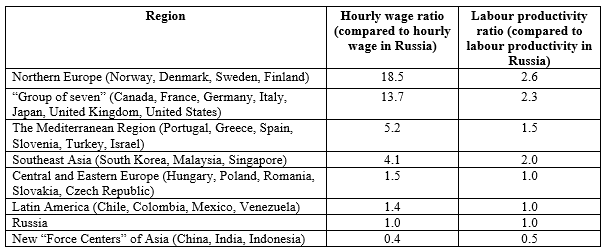

However, as one can see from Table 1, hourly wage rate in Russia was 13.7 times smaller than that of “Group of seven” countries and even 18.5 smaller if compared to the countries of Northern Europe. Meanwhile when the production of added value per 1 employed person is considered, the gap is not that enormous: labour productivity in Russia is 2.3 times smaller if compared to “Group of seven” and 2.6 times than that of Northern Europe. This implies, as Nureyev (2009) notes, at least two conclusions. The gap in labour productivity (2.6 times) gives evidence that Russia has huge reserves for its increase. At the same time the wage gap actually allows taking advantage of potential wage growth as a stimulus for increasing labour productivity. The latter assertion might be true only if the indicated gap (i.e., gap in wage rates and labour productivity) was not that grievous. Such low wage rates simply do not ensure high-quality and full-fledged reproduction of an employee, especially of a creative worker.

Table 1. Ratio of the hourly wage rates and labour productivity in Russia and other countries of the world (data as of 2004) (Belousov, 2005)

Table 1 shows differences in such crucial macroeconomic parameters as hourly wage rates and labour productivity in industries between Russia and other countries. Wages in countries of Northern Europe (Norway, Denmark, Sweden and Finland) are 18,5 times higher than wages in Russian industries; while the added value, created by 1 person employed in industries in this group of countries is only 2,6 times higher than that of Russia. The reason of the low share of wages in GDP, according to Lvov and Pugachev (2001), is related to the fact that the share of wages in the growth of labour productivity in Russia does not go in any comparison with an analogous share in productivity increment of the Western countries. The wages in Russia are low; moreover they are intolerably low in relation to the low labour productivity. Actually, the latter might be linked to poor living conditions. As Lvov and Pugachev (2001) notice, one US dollar in an average Russian worker‟s salary makes approximately 3 times greater GDP, than compared to that of an American. Such high exploitation of hired labour force is not known within any advanced economy of the world. During the years of reforms, the real salary rates decreased almost 3 times, and the per capita income declined 2 times. These scissors grew even bigger in the result of so-called “soft” devaluation of rouble in the beginning of year 2009.

According to Lvov and Pugachev (2001), sound rise of wages, supported by large-scale structural economy re-orientation maneuver towards consumer sector and institutional reforms, could be a way out of the present economic situation in Russia. The concept of national property proposed by Lvov in 1995-2000, has not lost its relevance till now. Its core idea is that efficiency of such industrial sectors as raw material extraction and manufacture as well as coherent governmentinitiated reforms should be defined mainly by contribution of these sectors into health-care and education of the nation, active demographic policy, comprehensive support of the younger generation, development of national business, preservation of natural environment. The lion‟s share of the rental income and income from economic exploitation of public property should be directed particularly towards these spheres. As the author suppose, it is purposeful to apply the neo-Keynesian approach for the analysis of this concept‟s efficiency. It should be noted, that namely this approach was used by the majority of countries of the world during period of their turning-point from breakdown to sustainable growth. USA did so during the Great Depression in the 30s of the last century. Germany overcame the post-war crisis and Japan took rise from the ruins in the same way. Likewise, South Korea and other Asian Tigers developed. Therefore, experience of Western countries in running fiscal policy is extremely useful. For example, Ershov‟s (2002) investigations show, that the mentioned countries‟ monetary base in formed by 80% under budgetary priorities, and not gold and foreign currency reserves, as it is done in Russia. Besides, considering peculiarities of Russian transition economy and its overmonopolization, it is necessary to limit monopolized structures through competition. As domestic competition in Russia is relatively weak, it should be supplemented with external competition from imports. The larger is their share in Russian domestic market, the less is the impact of the monopoly, and the lower is the inflation. As the result of distorted proportion between initial factors of production, the incomes of businesses and citizens are burdened unreasonably heavily, what demonstrates extreme inefficiency of current taxation system. It oppresses business, constrains growth of wages and final demand, artificially increases domestic manufacturers‟ production costs, reduces their competitiveness, and stimulates reduction of workplaces. This situation can be compared to creation of a sort of virtual economic system that Russia currently lives in. Meanwhile in real life, a significant part of incomes passes by the Treasury; instead it is swept by oilmen, gasmen, fishermen, metallurgists, foresters, and exported abroad in huge volumes. In other words, postulates of the liberal economic theory are not capable of describing and explaining the processes undergoing in Russia nowadays. In this case, the more suitable theory would be the Nelson and Winter‟s evolutionary theory of economic changes (Nelson and Winter, 1990). Supporters of the evolutionary theory represent organizational routines as economic analogy of genes, carrying hereditary information. Process of economic changes is designed in terms of selection of organizations, which in sight of organizational routines are mostly adapted to external environment. It is assumed, that “successful” routines (i.e. those, which raise level of adaptation) may be perceived by organizations through imitation or emulation, while changes in external environment requires pilot changes of routines, what leads to development of new set of “successful” routines. Within the framework of the evolutionary theory, its interpretation typically is related to the idea about inheritance of acquired attributes, for example, reproduction of the routines by method of imitation. Within the framework of the evolutionary theory, rejection to suggest perfect rationality of economic subjects and to highlight factor of organizational routines concludes, that result of evolutionary process not always corresponds to the principle of efficiency‟s maximization. First of all, the evolutionary theory emphasizes influence of external environment‟s parameters, with reference to which efficiency may not be a synonym of adaptability. Particularly, in the modern market economy numerical prevalence of hierarchical firms over the other forms of economic organization (for example, cooperatives) may be explained not by higher efficiency of hierarchical firms, but by specificity of cooperative creation‟s procedure, which limits opportunities for their growth in number. Secondly, enhanced attention is paid to the factors of initial conditions and to dependence on previous trajectory of development (path dependency). If implementation of certain technology or patterns of behavior entails feedback, which supports initially-made choice, its change becomes less probable (or impossible) even in that case, when choice ceases to meet efficiency‟s criterion. Thirdly, accumulation of behavioural changes that increase adaptability of individual firm may change the very external environment, i.e. in a result lead to change of adaptability criteria. Particularly, implementation of basic innovation by one of the firms may lead to creation of profitable market niche and induce other firms to carry out simulative innovations, what in the given industrial sphere may lead to the decline in rate of profit and to the freezing of excessive economic resources, which could be more productive in the other industries of economy. Suggestion about nonidentity principles of adaptability and efficiency underlies normative positions of the evolutionary theory, which in comparison with the neoclassical economic theory allows much wider range of opportunities for political interventions into economical processes. In this case as a major factor, that causes appropriateness of political activism, may be a necessity to adjust not “market failures”, but deviations of the evolutionary trajectory of development, which leads to the achievement of maximum level of adaptability, from the economically effective trajectory of development. The evolutionary approach not only denies interaction between economic systems and social contacts at various levels, but also assumes its hierarchy and heteroarchy. Though qualitative specificity of economic, political, moral, legal and other forms of relations remains, while subordination and coordination are taken into account in a sequence of forward and backward linkages. It is especially important, when in the modern scientific and academic literature replacement of economic attitudes with legal, psychological, political and moral progresses. Interaction is replaced with mixture. For example, “bundles of property rights” replace and subordinate its economic functions; legal and political relations are treated as initial in regard to economic. Application of the evolutionary approach allows re-view internal relations of science of human home, or in other words – of ecosystem. According to the evolutionary approach, economy may be understood and studied as real, developing organic system in aspects of logic, dialectics and gnoseology of its structure, functioning and genesis. This puts a problem of awareness of unity of ecology, economy and ecosophy as a triad of sciences and knowledge about home of the human race. This reveals relation between structural, functional and genetic aspects of the evolutionary approach. Knowledge of the sciences from one side and knowledge of social conscience and mental sphere from the other are frontiers for this block of sciences (Inshakov, 2004). In short, the classical economic theory yields to other concepts (Drobyshevskiy and Lugovoy, 2005) (for example, the theory of convergence adequately describes opportunities for equalization of levels and rates of economic development in Russian regions) and theories, that more tolerantly describe economic processes (in particular, hereditary and economic-genetic), which develop in modern Russia. The past of Russia prevails over it. Namely rental income, not Ricardo‟s labour theory of value, in Russia becomes a source of development of Western economies and one of the major factors of economy‟s criminalization. Traditionally tax system should carry out only role of complementary system of incomes, forthcoming from use of natural capital. In this case, taxes would not oppress manufacture, while yield interest from use of natural capital would be the major source of economic reforms. But what if to anticipate this question a little bit and to imagine, that question of natural capital is solved, i.e. taxes will be charged from users of natural resources. Then, there comes another question: for whosebenefit would interest on natural capital be charged? To which accounts would it be credited? The State as an authorized public institute gathers the interest and keeps it, enlisting interest into appropriate income article of the State budget. That is called embezzlement. Officials as part of the society would appropriate public wealth; however, it happens currently, using the “blue chips”, i.e. oil/gas/ore monopolies). Even in our over-cynical time all of this would be too straight and shameless. Society may get worried. Let‟s consider another option. Imagine, that the State takes over only operator„s functions. It will charge interest, but where it should be directed to then? Simply there is no place for it. It is necessary to acknowledge, that in this case proper financial infrastructure haven‟t been created yet. Of course, it is possible to follow the State, which has formed fiscal stabilization fund, based on revenue from oil and gas exports. However, in practice implementation of this idea faces many questions; and in society there is no unambiguous estimation of its final benefit for the country‟s economy. It became more obvious during financial crisis swelling: in autumn of the last year 175 billion rubles from budgetary fund of future generations were spent for stock market maintenance through commercial banks; actually stock market hasn‟t got it. Though President of the Russian Federation Medvedev has recognized inaccuracy of this step. Nevertheless, the main question still remains open: is it purposeful to accumulate such huge funds in foreign banks, making for them profit? Besides that, in the situation of investment starvation the real Russian sector experiences a shortage of loan capital under accessible loan interest rates. According to May 1st, 2009 average weighted average loan interest rate in the EU countries does not exceed 0.5–2.0 %, whereas in Russia – 18.5-21.5 %. Considering the above mentioned, it is necessary solve question of interest on natural capital in an absolutely different way. It is spoken much enough about necessity of improvement of subsurface management in Russia (Institute of Economy of the Russian Academy of Science, 2004). In the context of knowledge economy‟s development, and particularly on the first stages of new knowledge emergence, government‟s policy towards R&D activity becomes another important aspect. In this case reduction of prices for knowledge is impossible without reduction of knowledge dissemination. Therefore, reduction of budgetary appropriations for fundamental science obviously would lead to degradation of science. As Rubinstein (2002) points out, this phenomenon defines boundaries of that part of market, inside which requirement for efficiency improvement of marketled scientific sphere‟s activity turns around as threat of catastrophic collapse of knowledge production in the country. So, the State‟s defining role in implementation of protectionist policy towards fundamental science and R&D sphere is obvious. Such policy should be not a charity, but rather responsibility of the State, which is able to involve mechanisms for stimulation of knowledge dissemination. These mechanisms primarily include tax concessions, targeted direct grants, and legislation for protection of author‟s copyrights and for ensuring of author‟s awards. The legislation for expansion of author‟s intellectual property rights related to discoveries and inventions should become essentially important tool of stimulation of knowledge production. Moreover, mechanisms of privileged crediting of prioritized research and development. Target programming methods may play a considerable role in creation of competitive high-tech products. Speaking about how considered system could “work” in the context of regional economy, the author‟s proposal is as follows. It is necessary to create (and quickly) a single regional-federal system of funds for natural capital‟s accumulation. The control over this system should be authorized to the Public Chamber within subjects of the Federation as well as the Federal Centre. These funds could be named “regional development funds” (Kolosovsky, 2006) or “funds for future generations”, and etc. But entitlement of such organizations is not the essence. The point is that society needs to realize, that each of us and civil society as a whole losses great resources for development. There is a necessity for reasonable dispose of these enormous funds. Under the Constitution natural resources should serve and belong to civil society, i.e. to each of us. They should be used with the prospect, but not be wasted, because under current extraction paces oil is remained only for 40 years. Therefore it is necessary to establish author‟s offered system in the shortest terms. Funds, accumulated by it, should become a powerful source of long-term investments for Russian economy‟s growth, for development of civil society, which will receive a legitimate source for additional funding of socially significant programs. The author thinks that none situation might be considered inviolable. Finally, much depends on the right strategy of the Government, which is supported by the community that always possesses certain resources; it is only necessary to use them wisely considering the interest of the same community.

Conclusions

The above research might be summarized in the following way. On the border of 90s of the 20th century, the pure economism entered into Russia. In other words, economic society, that has prevailed in Russia as an external force has “dragged” Soviet-Russian society into the global economic civilization. The rental economy which gradually becomes obsolete has no future. Strive for profit (not typical for all people), which is not ensured by adequate input of labour or other forms of capital, pushes passionate, talented and inventive people to different tricks, extraordinary steps with the aim to multiply their wealth. The research showed that impartiality of the capitalization process that is related to mechanism of functioning of global capital, as well as efforts of states‟ governments that are supported by civic society might increase role and effectiveness of the national economy substantially. Further presented concept of global capital is built on paradigm of fully-economized society, founded on the theory of global universal capitalist economy. Capital in all forms is evidenced everywhere, where person receives income from his / her economic activities. According to the introduced concept, global capital contains the following elements: human, social-corporate, organizational, physical, financial, natural-geographic, political-administrative capital. For all forms of global capital it is common that revenue is in fact interest on capital (not profit or wage or natural rent, etc.). This approach equalizes all players in the process of reproduction of global capital. Meanwhile, human capital remains to be the most important as it forms the basis of postindustrial economic society. Basing on the theoretical background, analysis of the structure of global capital in Russia showed that conceptually obsolete approach towards assessment of component resources of factors of production and the income they generate leads to threatening disproportion in primary allocation of resources. This derives in the results of distorted proportions of primary forms of capital existing in the Russian economy. Consequently, due to extremely ineffective current taxation system, unreasonably high burden on business and citizens‟ income has formed in Russia. Not only this situation restrains development of business and limits growth of hired workers‟ incomes and final demand; it also enhances local production costs unnaturally meanwhile decreasing its competitiveness and invokes decline in available workplaces. As number of Russian authors presume, in order to use natural rent effectively, it is necessary to have different taxation policy which would only take role of system, supplementing rental payments. New taxation reform is needed urgently, which would allow reducing labour levy and deductions from profit sharply; as well as retracting Value added tax and reducing and later retracting Consolidated social tax for companies. The article offers mechanism for ensuring enlarged reproduction of human capital, which is the economic basis for development of human sphere: science, education, healthcare, culture and arts, freedom of movement. As regards Russia, source for development of human capital and its increased reproduction, is motivated, highly-qualified and highly-reproducible labour together with such Russian treasures as natural capital, i.e. natural subsoil resources (oil, gas, ores of coloured and rare-earth metals, etc.) The author considers that the processes ongoing in the modern Russian economy cannot be described basing only on neoclassical economic theory. In recent years, new methodological approaches have appeared in the economics that have enriched the gnoseological machinery. In order to properly describe the ongoing processes, methodology of evolutionary economics, economic genetics theories, theories of irrational behaviour, mental economy and other methodologies of neo-institutional economics might be used successfully. Apart from that, the past weighs upon Russia and because of that answers to many questions of today‟s Russian economy should be searched namely in the past.

References

- Becker, G. (1964). Human Capital, New York.

- Belousov, A.R. (2005). Long-term trends of Russian economy. Report. Available at: http://www. economy.gov.ru

- Coleman, J.S. (1990). Foundations of Social Theory. Cambridge, MA: Harvard University Press. P. 302.

- Drobyshevskiy, S., Lugovoy, O. (2005). Factors of economic growth in regions of the Russian Federation. Moscow: IEPP, Agency CIP RGB, P. 278.

- Ershov, М.V. (2002). About a policy of economic growth. Questions of economy, No. 2, p.13.

- Inshakov, O.V. (2004). Evolutionary the approach in an economic science of modern Russia. Philosophy of facilities. The almanac of the Centre of social studies and economic faculty of the Lomonosov‟s Moscow State University, No. 4 (34).

- Fisher, S., Dornbush, R., Shmalensy, R. (1990). Economics. Chapter 18.

- Kolosovsky, A.M. (2006). Economy of the special subject of Russia. Monograph. Kaliningrad: Publishing house “Kaliningrad State Technical University”. P. 234-236.

- Lvov, D.S., Grebenshchikov, V.G., Ustiuzhanina, E.V. (2001). Concept of national property. Questions of economy, No.7, pp. 19-26.

- Lvov, D.S., Pugachev, V.F. (2001). Mechanism of stable economic growth. The Economic science of modern Russia, No. 4, p. 52-58.

- Nelson, R.R., Winter, S.G. (1990). An Evolutionary Theory of Economic Change. The Belknap Press of Harvard University Press/Cambridge, Massachusetts, and London, England. Р. 356;

- Nureyev, R.M. (2009). Russia: Features of institutional development. Moscow: Norma. P.376

- Osipov, J.U. (2003). Time of philosophy of facilities. (Three books). Moscow: Economist. P.187-192.

- Putnam, R., Leonardi, R., Nanetti, R. (1993). Making Democracy Work: Civic Traditions in Modern Italy, NJ: Princeton University Press.

- Rubinstein, A.Y. (2002). To the economic theory of cultural activity. Moscow: State Institute of arts investigations and a social policy of the Russian Academy of Science, p.13.

- Samuelson, P., Nordhaus, V.D. (1987). Economics, 15th edition. Chapter 14.

- Institute of Economy of the Russian Academy of Science (2004). The Strategic answer of Russia to calls of new century. Under com. edition by Abalkin, L.I. Moscow: Publishing house “Examination”. P. 329-350.

- Van Deth, J.W. (2000). Interesting but Irrelevant: Social Capital and the Saliency of Politics in Western Europe. European Journal of Political Research, No. 37, pp.115-147.

- Volkov, O.I., Sklyarenko, V.K. (2008). Economy of enterprise. Moscow: INFRA-M. P. 276-279.