Kumar N., Verma P. (2008). Credit Deposit ratio and ownership structure in the Indian banking sector: an empirical analysis. Global Academic Society Journal: Social Science Insight, Vol. 1, No. 4, pp. 4-17. ISSN 20290365. [www.ScholarArticles.net]

Authors:

Nitin Kumar, Reserve Bank of India, India

dr. Puneet Verma, Reserve Bank of India, India

Abstract

For an emerging economy like India, it is vital to have sound financial intermediaries and commercial banking sector, which effectively mops up the savings available with the public and disburses credit to the productive sector in an efficient manner helping India to progress on the path of steady growth and prosperity. The study is an attempt to assess whether some bank groups are better at delivering the required outcome. Using the econometric techniques over the time horizon of 1991 to 2006 and controlling for certain structural characteristics, it is revealed that the foreign bank group has exhibited the best credit deposit ratio, whereas some attention is still required in case of public sector banks where further scope for improvement exists. The paper provides a brief overview of banking structure in India, explains the model and the methodology, which has been applied in the study followed by empirical results. The summary of major findings and policy implications is provided in the paper as well.

Introduction

The role of a well-developed banking system in stimulating and sustaining a country’s economic growth is well recognized. The banking sector plays a vital role in financial intermediation by mobilizing deposits and disbursing credits to various sectors of the economy. Therefore, the quality of functioning of the banking sector in turn affects the performance and productivity of other sectors of the economy. Recognizing this, banking sector reforms were initiated in India along with the economic reforms. The objective of the banking sector reforms was to promote a diversified, efficient and competitive financial system with the ultimate objective of improving the allocative efficiency of resources through operational flexibility, improved financial viability and institutional strengthening (Mohan, 2006a). Likewise, enabling access to a greater number of the population to the structured and organized financial system has explicitly been accepted by the Reserve Bank since 2004. The Reserve Bank has introduced various new measures to encourage the expansion of financial coverage in the country. Not only is financial inclusion essential because of its implications for the welfare of citizens but also it needs to be stressed that it has to be an explicit strategy for fostering faster economic growth in a more inclusive fashion (Mohan, 2006b). The commercial banks accept deposit from public and institutions on which the banks pay reasonable interest. The bank grants loan from this amount and charge interest at a higher rate. The difference between the interest rates is the profit of the bank. These loans are generally granted to the traders, industrialists, farmers and self employed persons. The total bank deposit is one of the indices that mirror the effectiveness with which the financial intermediaries mop up the savings available with the public. When bank grants loans to its customer, it generally does not lend out cash, equal to the amount of the loan, to the customer as an individual money lender does, but on contrary, opens an account in borrower’s name and credit the amount of loan to his/her account. Thus, when bank grants a loan, it creates a deposit or a liability against itself. Since the deposits of the bank circulate as money, the creation of such deposit leads to net increase in the money stock of the economy. Thus, credit creation indirectly increases the supply of money in the economy. Bank’s lending and investment activities lead to changes in the quality of money in circulation, which in turn influence the nature, and quality of production. The volume of total bank credit disbursed shows the extent to which the productive sector had availed itself of credit from the commercial banks and other financial intermediaries. The Credit Deposit (CD) ratio henceforth, is the proportion of loan-assets created by banks from the deposits received. The higher the ratio, the higher the loan-assets created from deposits.CD ratio reveals the efficiency with which the commercial and financial intermediaries are tapping savings from the available sources and canalizing these to various productive activities of the economy. It is very important to have strong financial system, which acts as an engine of growth and development for fast developing nations. The importance of sound financial system in mobilizing deposits and disbursing credit for productive utilization is well documented in studies such as Levine et al. (1999), King and Levine (1993), Rajan and Zingales (2001), Jayaratne and Strahan (1996). The study is an attempt to assess whether some bank groups are better at delivering the required outcome. The paper is organized as follows. At first, it provides a brief overview of banking structure in India followed by discussion of relevant literature. It also explains the model and the methodology, which has been applied in the study followed by the empirical results.

A brief overview of the banking structure in India

Earlier, the colonial banks in India were biased toward working capital for trade and large firms (Joshi and Little, 1996). The government perceived that banks should extend financial resources to strategically important sectors to assist India’s planned development strategy. The partition of India in 1947 adversely affected the banking activities. Post independence major steps were initiated to regulate banking and finance in India. In 1949, the Banking Regulation Act was enacted which empowered the Reserve Bank of India (RBI) to regulate, control, and inspect the banks in India. Before 1969, State Bank of India (SBI) was the only public sector bank in India. SBI was nationalized in 1955 under the SBI Act of 1955. Under the prime ministership of Smt. Indira Gandhi 14 largest commercial banks were nationalized from the midnight of July 19, 1969. The major objective behind nationalization was to spread banking infrastructure in rural areas and to make available cheap credit to rural population. This was followed by nationalization of 6 more banks in 1980, to give government more control of credit delivery. The government of India controlled around 91 per cent of banking business with the second phase of nationalization. With the aim of improving the efficiency of rural credit delivery mechanism in India, the Narasimham committee conceptualized the creation of Regional Rural Banks (RRBs) in 1975, which would combine the local feel and familiarity of rural problems with the professionalism and large resource base of commercial banks. Thus, RRBs were setup through the RRBs Act of 1976. The equity of RRBs is held by the central government, the concerned state government and the sponsor bank in the proportion of 50:15:35. Since then, the RRBs have become an integral component of the Indian banking sector, helping the development of rural economy through the knowledge of local peculiarities by disbursing credit to farmers, agricultural labourers, artisans, small entrepreneurs etc. But the financial viability has been an issue of concern for RRBs since its inception. The issue has been dealt with in many government committees and reports to improve the profitability and its possible restructuring. Reforms were introduced in India in 1991 to offset the perennial balance of payment crisis. It included reduction in external tariffs, the introduction of a flexible exchange rate and the substantial liberalization of all transactions in foreign exchange, which led to strong balance of payment position for India. Prior to deregulation, the banking sector had stringent regulatory requirements related to Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) that required banks to hold a certain amount of government and eligible securities, low interest rates charged on government bonds (as compared with those on commercial advances), concessional lending, administered interest rates, and lack of competition. These factors kept the Indian economy devoid of healthy competition in the banking sector by inefficient resource allocation in favour of few public sector banks. The Narasimham Committee reports of 1991 and 1998 formed the basis of the banking sector reforms in India. It advocated a shift of banking sector supervision from intrusive micro-level intervention over credit decisions toward prudential regulations and supervision, a reduction of the CRR and SLR, interest rate and entry deregulation, and adoption of prudential norms, based on the recommendations of the Narasimham Committee on Financial Sector Reforms. The fundamental philosophy underlying the reforms was to make the banking system more responsive to changes in market conditions and to reduce the intervention of the RBI to that of an arm’s length regulator. Earlier the Public Sector Banks (PSBs) were fully owned by the government. But post reforms, they were allowed to access capital market to raise up to 49 per cent of their equity. This led to greater operational autonomy for these banks as earlier there was considerable level of government intervention. Since the initiation of the reforms, signs of increased competition have appeared in the Indian banking industry. The performance of public banks has also become more market-driven with growing emphasis put on profitability as an important benchmark for evaluating their performance by policy makers in the post reforms era. Meanwhile, a consensus is emerging that state ownership of banks is detrimental for financial sector development and growth. Based on data from the 10 largest commercial and development banks in 92 countries for 1970-1995, La Porta et al. (2002) have found that greater state ownership of banks in 1970 was associated with less financial sector development, lower growth, lower productivity, and that these effects were greater at lower levels of income. Barth et al. (2001) have shown that greater state ownership of banks tends to be associated with higher interest rate spreads, less private credit, less activity on the stock exchange, and less non-bank credit, even after taking into account other factors that could influence financial development. This suggests that greater state ownership tends to be anti-competitive, reducing competition from both banks and non-banks. Barth et al. (2001) and other economists have also noted that applications for bank licenses are more often rejected and there are fewer foreign banks when state ownership is greater. Moreover, Caprio and Martinez-Peria (2000) have shown that greater state ownership at the start of 1980 was associated with a greater probability of a banking crisis and higher fiscal costs. It should also be noted that premature privatization might give rise to banking crises. Clarke and Cull (2002) have demonstrated that Argentina promoted the privatization of public-sector banks in a reasonably developed regulatory and infrastructure environment, and thus privatized banks improved productivity remarkably. Overall various studies about the Indian commercial banking sector suffer from a number of drawbacks: the relatively short time period observed, the limited sample size used, and the static nature of the analytical method employed. The Reserve Bank of India has allowed commercial activities such as securities related transactions, foreign exchange transactions and leasing activities. Post reform period has witnessed improvement in the performance of some large public sector banks due to (a) the import of better risk management skills from foreign and private domestic banks, (b) intensified competition, (c) the diversification effect described above, (d) reorganization (for example, mergers and acquisitions), and (e) goodwill. The Reserve Bank of India controls the creation of credit using suitable methods and instruments in such a manner, so as to bring ‘Economic Development and Stability’. It means bank will accelerate economic growth on one side and on the other side RBI will control inflationary trends in the economy. It leads to increase in real national income of the country and desired stability in the economy. Over the years the banking system has taken deep roots in India. Currently, with 81 Scheduled Commercial Banks (excluding regional rural banks), which includes 28 public sector banks, 29 foreign banks and 24 private banks with about 58,725 offices across the nation, the Indian banking sector is considered as fairly mature in terms of the product range supplied and it reach to varied sections of society (Reserve Bank of India, 2007). The last decade and a half has seen tremendous computerization for faster and enhanced customer service. The network of automated teller machines (ATMs) has grown more profuse. Apart from internet banking, tele-banking and so on banks today provide varied services, such as, demat accounts, bill payment etc, which has made banks an integral part of day to day life.

Analysis of CD ratio and ownership structure in the Indian banking sector: model and methodology

The banking sector in India consists of various ownership groups. It may be possible that certain bank groups are averse to cater to small borrowal accounts, which are large in number, and their servicing entails a higher cost per account. It has been pointed out by Nanda (1999) that lack of working capital is the major reason cited as a reason for the failure of small businesses, the real reason for which is the attitude of banks towards small entrepreneurs. Certain bank groups may be averse to lend to certain specific unattractive sectors or it can be simply risk averse policy that is reflected in low CD ratio. The issue has been dealt with after controlling for bank-group wise characteristics. The entire banking sector is divided into three main groups i.e. public, foreign and private. Obviously, one would like to work with simple and straightforward models as far as possible. These models should be well designed to get reliable and logical forecasts. As per the discussion in the previous sections the general form of the model estimated is the simple linear regression as follows:

![]()

The CD ratio has been taken as the endogenous variable, which proxies for the operationa structure. Among the exogenous variables time variable has been taken to capture the effect of policy changes on CD ratio. With the passage of time as the banks get more established, generally, there is an improvement in management performance and operational structure. Hence, it is expected that time will have positive effect over CD ratio. Foreign and private ownership dummies are included in the model to assess their performance relative to public sector banks. The variable X denotes the vector of control variables, which are included to capture the differences in the regulatory environment and structural characteristics across various bank groups to isolate the ownership effect. Among the control variables included are proportion of rural and urban branches and natural logarithm of total assets, as has been taken in earlier studies by Sarkar et al. (1998). Rural and semi–urban figures have been clubbed together which gives us rural branches, and urban and metropolitan branches have been clubbed, which has been used as number of urban branches. is the disturbance term incorporated to capture the noise in the data with usual classical linear model assumptions. All the monetary variables have been converted to real by taking them at 199394 prices. The intercept parameter is denoted by α, whereas, the vector of slope parameters associated with the variables X are denoted by δ. Equation (1) is the general model of CD ratio; simultaneously public vs foreign, public vs private and foreign vs private were fitted thus giving the total of four models. Since during the study years some policy changes, like banking sector reforms introduced in the 1990’s in India, took place, which may have an influence on the CD ratio, structural changes/ shift has been tested using the Chow test (Chow, 1960). Data on bank group wise credit and deposit and number of bank branches have been obtained from the annual publication, Basic Statistical Returns of Scheduled Commercial Banks in India published by Reserve Bank of India. Assets are taken from ‘Statistical tables relating to Banks in India’ published by RBI. Data was available from 1976 to 2006 except for foreign banks. Foreign bank data was available from 1991 to 2006. As the simple linear framework has been used, the least-square principle was used to estimate the parameters of the above model. The software SAS has been used for carrying out the analysis. Residual plots were also applied to check the adequacy of the developed models. The validity of most of the assumptions relating to linear regression theory was also confirmed through the graphs of residuals. A single or a set of observations may be inconsistent with the rest of the observations in the data set. This inconsistency may be due to the dependent variable or any one or more of the independent variables having values outside expected limits. These data point/s may be outlier/s or a potentially influence point because of errors in the conduct of the study or because the data point is from a different population. In this study ‘Box plot’ method was used for detecting outliers.

Comparison of CD ratio and ownership structure in the Indian banking sector: empirical results and discussions

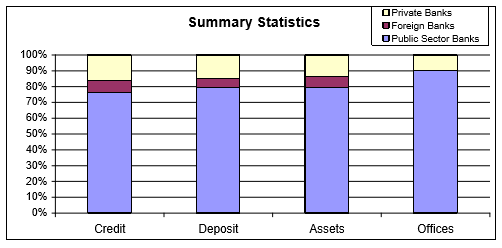

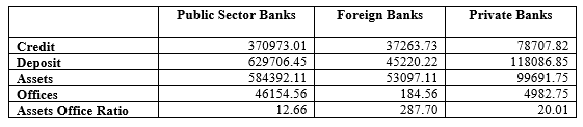

Basic summary statistics according to bank groups is presented in Table 1 and Figure 1.

Table 1. Summary statistics across bank groups (group average: 1991 to 2006), in Rs Crore

Figure 1 clearly shows that public sector banks in India form the largest bank group in India both in terms of size and spread. It constitutes around 79 per cent of the total assets and almost 90 per cent of the total branches. Among the private and foreign banks, the private banks occupy slightly more than foreign bank groups.

Figure 1. Percentage bar representation across the banks

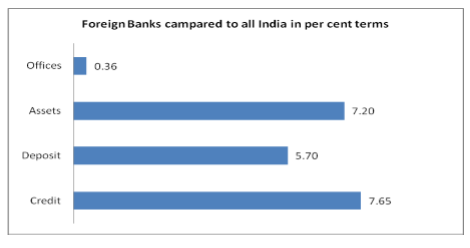

Foreign banks offices in India are negligible but their share to credit and deposit are comparably high (see Figure 2). This may be because their asset ratio per office is comparably very high.

Figure 2. Profile of foreign banks in India (in percentage)

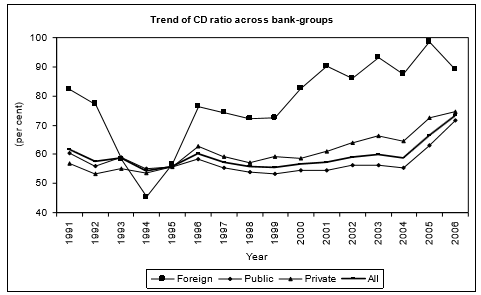

Figure 3 shows pattern of CD ratio for the period of study. The CD ratio of foreign bank group seems to be considerably higher than that of the all-India average except for the period 1993 to 1995. However, for the public sector banks and private banks it has been moving close to close and in tandem. But at the same time the consolidated graph depicts that foreign group weight is negligible to the whole economy as foreign CD ratio variation could not made any larger impact on overall CD ratio.

Figure 3. CD ratio across bank-groups

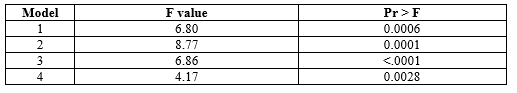

It would be interesting to study if these policy implications have led to any structural shift in the model. From Figure 3, it looks that CD ratio of all bank groups are in upward trend from 1999 onwards. If to see literature, one can find report on Banking Sector Reform (Narasimham Committee, 1998). Considering that as a policy measure, structural break at 1999 was tested for all bank groups. Test statistics are shown in Table 2.

Table 2. Chow test statistics at the point 1999

Table 2. Chow test statistics at the point 1999

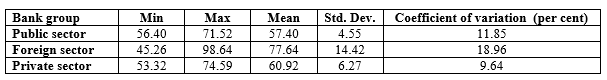

From Table 2 it is clear that there is a significant change after Narasimham Committee (1998) report with one year time lag. An F-test is any statistical test that tests whether the means of multiple normally distributed populations, all having the same standard deviation, are equal. Pr > F is the p-value, which provide the statistical test of significance. The decision is often made using the p-value: if the p-value is less than the significance level, then the null hypothesis is rejected. The smaller the p-value, the more significant the result is said to be. Hence, in our case all the models are coming to be significant. Table 3 shows summary statistics of the CD ratio across bank groups as well as for all combined bank groups. Results presented in Table 3 show, that the CD ratio for the foreign banks has the maximum variation followed by public sector banks and private sector banks as seen in Figure 3.

Table 3. Summary Statistics of CD ratio

Table 3. Summary Statistics of CD ratio

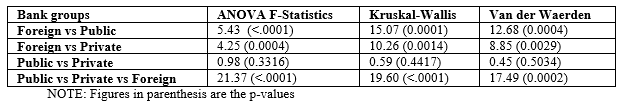

Now, a logical query which arises next is whether the CD ratio across bank groups differs significantly. The parametric analysis of variance test (t-test for difference of means in case of pairs) for equality of means, the Kruskal-Wallis and the non-parametric test for the equality of medians are provided in Table 4.

Table 4. Test statistics for equality of CD ratio

Table 4. Test statistics for equality of CD ratio

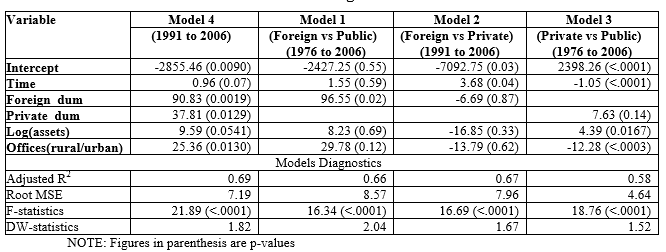

The tests indicate that foreign bank group CD ratio differs significantly from public banks and private banks. But CD ratio of private and public banks does not differ significantly. In the study it is attempted to explain these differences using simple linear regression models, after controlling the difference in their operating characteristics. Table 5 shows fit and diagnostic statistics of all four models. It seems to indicate a satisfactory fit for all the models.

Table 5. Regression results

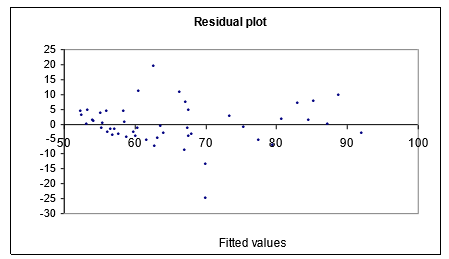

From the model diagnostics given in Table 5, it looks that all the models are fitted well. Figure 4 depicts the residual plot for the model 4. As it can be seen from Figure 4, there does not seem to be any systematic pattern being followed, suggesting an adequate fitting. Similar results are found in all other three models.

Figure 4. Residual plot of model 4

The consolidated information has been taken in model 4 where foreign and private dummy were positive (more than one) and significant but time was not significant at 5 per cent. Among the control variables ratio of rural and urban branches coefficient was positive and significant at 5 per cent level but log (asset), though it was positive but not significant at 5 per cent level but significant at 10 per cent. Hence, both the considered controlled variables were significant at least at 10 per cent and had positive impact on CD ratio. As shown in model 1, coefficient of foreign dummy is positive (more than one) and significant, implying that foreign bank group had better CD ratio as compared to public sector banks. In case of foreign vs private banks (model 2) no definite conclusion regarding superiority can be drawn as the coefficient of foreign dummy is not significant. Similar conclusion holds for private and public banks (model 3) as the coefficient is not significant. However, no definite conclusion can be drawn for model 3 as the time and coefficient of rural and urban branches is negative. Contrary to findings in model 3, the coefficient of private dummy variable in model 4 is coming out to be significant and positive, which could be due to shorter time period. As found in model 1 and model 4 the foreign bank and private bank groups seems to be performing better as compared to public sector banks for CD ratio.

Conclusion and policy implications

From the study results it may be concluded that Public Sector Banks (PSBs) are spread all over the India with highest asset, credit and deposit, whereas foreign banks with comparatively fewer offices are having large assets as far as per office ratio is concerned and are contributing a good share of credit and deposit in the Indian economy. The Private bank group is the second largest group in terms of credit and deposit with comparably less number of offices than that of PSBs. The linear model considered in the study using foreign and private bank group dummies indicates that the foreign and private bank groups are performing better in terms of CD ratio as compared to the public sector banks. From the study it is also revealed that the ratio of rural-urban offices has a positive impact on CD ratio. Additionally, it seems that assets are having a positive influence over the CD ratio with less level of significance. Moreover, it has been found that there has been a structural break in CD ratio in 1999 in India.

References

- Barth J. R., Caprio G., Levine R. (2001) The regulation and supervision of banks around the world. In: Litan R. E., Herring R. (Eds.), Integrating Emerging Market Countries into the Global Financial System, BrookingsWharton Papers on Financial Services (Brookings Institution Press, 2001), pp. 183-240.

- Caprio G., Martinez-Peria M. S. (2002) Avoiding Disaster: Policies to Reduce the Risk of Banking Crises. In: Cardoso E., Galal A. (Eds.), Monetary Policy and Exchange Rate Regimes, Cairo: The Egyptian Center for Economic Studies.

- Chow G. C. (1960) Test of Equality between Sets of coefficients in two linear regressions. Econometrica, Vol. 28, No. 3, pp. 591-605.

- Clarke G., Cull R. (2002) Political and Economic Determinants of the Likelihood of Privatizing Argentine Public Banks. Journal of Law and Economics, Vol. 45, No. 1, pp. 165-197.

- Jayaratne J., Strahan P. E. (1996) The finance-growth nexus: evidence from bank branch deregulation, Quarterly Journal of Economics, Vol. 111, pp. 639-670.

- Joshi V., Little I. M. D. (1996) India’s Economic Reforms 1991-2001. Clarendon Press Oxford.

- King R. G., Levine R. (1993) Finance and Growth: Schumpeter Might Be Right. Quarterly Journal of Economics, Vol. 108, pp.717–738.

- La Porta R., Lopez-de-Silanes F., Shleifer A. (2002) Government ownership of banks. Journal of Finance, LVII, No. 1, pp. 265–302.

- Levine R., Loayza N., Beck T. (1999) Financial Intermediation and Growth: Causility and Causes. The World Bank, Washington, D. C. (World Bank Policy Research Working Paper 2059).

- Mohan R. (2006a) Reforms, Productivity and Efficiency in Banking: The Indian Experience. Reserve Bank of India Bulletin, March 2006.

- Mohan R. (2006b) Economic Growth, Financial Deepening and Financial Inclusion. Reserve Bank of India Bulletin, November 2006.

- Nanda, K.C. (1999) Credit and Banking – What every small entrepreneur (and Banker) must know. Response Books.

- Narasimham Committee (1991) Report of the Committee on the Financial System. Narasimham Committee, Mumbai.

- Narasimham Committee (1998) Report of the Committee on Banking Sector Reforms. Narasimham Committee, Mumbai.

- Rajan R. G., Zingales L. (2001) Financial systems, industrial structure, and growth. Oxford Review of Economic Policy, Vol. 17, No. 4, pp. 467-482.

- Reserve Bank of India (2007) A Profile of Banks 2006-07: Reserve Bank of India Publication.

- Sarkar J., Sarkar S., Bhaumik S. K. (1998) Does Ownership Always Matter?-Evidence from the Indian Banking Industry, Journal of Comparative Economics, Vol. 26, pp. 262-281.