Vashakmadze T. (2012). ETF portfolio rebalancing for retail investors. Global Academic Society Journal: Social Science Insight, Vol. 5, No. 13, pp. 13-22. ISSN 2029-0365. [www.ScholarArticles.net]

Download/print: *.pdf.

Author:

Teimuraz Vashakmadze, Russian Presidential Academy of National Economy and Public Administration; Centmillion AG, Russia

Abstract

In this paper it is aimed to show empirically that retail investors can improve performance of the portfolio just using periodic portfolio rebalancing strategy and recommendations for retail investors based on empirical analysis are proposed in the paper. Empirical analysis shows that any periodic rebalancing improves the Sharpe Ratio, but the periodic rebalancing not always decreases the standard deviation or increases the returns of the portfolio. Analysis shows that annual rebalancing improves the Sharpe Ratio in the best way. As for retail investors it can be recommended to conduct annual rebalancing for ETF (Exchange Trade Fund) portfolio.

Introduction

Asset allocation can be considered as a key factor in investment performance. As we know prices for financial assets fluctuate and hence one type of asset in a portfolio can increase in value and another decrease, so such a situation can lead that initial target allocations will change. Change in original target allocations can increase risk or lower returns and hence make impossible for investors to achieve initial investment aim. Research shows that it is an issue for retail investors (ICI, 2000). Research conducted by Investment Company Institute shows that majority 401 (k) participants did not actively manage their plan assets after making initial investment decisions. This phenomenon is well known in behavioral economics and can be characterized as a status quo bias (Samuelson and Zeckhauser, 1988; Kahneman et al., 1991). A status quo bias explains why retail investors are increasing risk without knowing it. On the other hand research (Beach and Rose, 2005; Beach and Rose, 2008) shows that portfolio rebalancing appears to help investors achieveinvestment goals and overcome behavioral mistakes in investing. Hence, it is important that on a periodic basis researchers will produce new empirical evidence about portfolio rebalancing and communicate the results to retail investors. Rebalancing is a tool for investors that bring the portfolio into configuration with the original target allocation of assets. If professional investors individually or via professional money managers know about rebalancing and use it, talking about retail investors it is not always a case. In this paper it is aimed to show empirically that retail investors can improve performance of the portfolio just using periodic portfolio rebalancing strategy. And recommendations for retail investors based on empirical analysis are proposed in the paper.

Types of portfolio rebalancing strategies

Rebalancing is a tool for investors that bring the portfolio into configuration with the original target allocation of assets. If professional investors individually or via professional money managers know about rebalancing and use it, talking about retail investors it is not always a case. Investment world practitioners suggest different rebalancing strategies. Types of strategies might be as follow (Nersesian, 2006; Montague, 2007):

- Periodic Rebalancing. Portfolios are reset to their original allocations on a fixed schedule – such as annually, quarterly or monthly. A big advantage of this strategy is simplicity.

- Threshold Rebalancing. Portfolios are adjusted to the original mix if and when a particular asset class deviates from its target allocation by more than a certain amount.

- Range Rebalancing. This approach is similar to Threshold Rebalancing, but portfolios are not adjusted to their original allocations, it is rebalanced back to the maximum level.

- Midpoint Threshold Rebalancing. In this scenario, moves beyond the threshold are corrected by returning to the midpoint of the range.

- Volatility-Based Rebalancing. Triggers are based on the expected volatility of the portfolio as a whole. When volatility rises above a certain predetermined threshold, higher-volatility asset classes are sold and lower-volatility asset classes are purchased.

- Active Rebalancing. Portfolios are rebalanced to the original target allocations as needed, based on analysis of expected market conditions. Volatility-Based Rebalancing. Triggers are based on the expected volatility of the portfolio as a whole. When volatility rises above a certain predetermined threshold, higher-volatility asset classes are sold and lower-volatility asset classes are purchased

- Active Rebalancing. Portfolios are rebalanced to the original target allocations as needed, based on analysis of expected market conditions.

Tokat (2006) and Gitsham (2011) point out that market environment have a big impact on the effectiveness of the rebalancing strategy. Gitsham (2011) writes: “In a trending market, where a stronger performing asset class in one period continues to outperform in the next period, rebalancing lowers the rate of return of the portfolio compared to a no rebalancing strategy. The investor continuously sells the stronger performing asset class and buys the weaker performing asset class… In a mean-reverting market, where a stronger performing asset class in one period becomes a weaker performing asset class in the next period, rebalancing may enhance the return of the portfolio due to the contrarian nature of the strategy.” But in the long-run Gitsham (2011) supports portfolio rebalancing and agrees that rebalancing tends to increase portfolio return and reduce risk. Research conducted by Weinstein et al. (2003) concludes that rebalancing works in both good and bad market conditions. On the other hand, Jaconetti et al. (2010) conclude that “Just as there is no universally optimal asset allocation, there is no universally optimal rebalancing strategy”. Analysis of Jaconetti et al. (2010) shows that “the risk-adjusted returns are not meaningfully different whether a portfolio is rebalanced monthly, quarterly, or annually; however, the number of rebalancing events and resulting costs increase significantly”. Portfolio rebalancing strategies were described and it showed that research supports portfolio rebalancing. But for retail investors only periodic rebalancing can be considered due to its simplicity.

Consideration of ETF portfolio

In general academics and practitioners share the opinion that rebalancing costs can play an important role. Usually costs occur because of 2 reasons: (a) portfolio consists of wide range of financial assets and (b) portfolio is rebalanced too frequently. For this reasons I think that retail investors should consider Exchange Traded Funds (ETFs). Retail investor can construct an interesting portfolio hypothetically using only 2 ETFs. If used ETFs corresponds the performance of equities and bonds, such ETF portfolio might be low cost and will help to achieve retirement investment objective.

Research objective

The objective of this paper is to test empirically periodic rebalancing strategy for 3 different portfolios constructed with ETFs. The following question will be addressed: should an ETF portfolio be rebalanced by retail investor based on a particular time frequency?

Research methodology

For empirical testing the following research methodology will be used:

- 3 hypothetical portfolios using two largest ETFs by assets have been constructed. Portfolios are as follow:

a. 75% equities and 25% bonds.

b. 50% equities and 50% bonds.

c. 25% equities and 75% bonds.

- ETFs used:

a. ETF SPY has been used for equities. The SPY ETF is a fund that corresponds to the price and yield performance of the S&P 500 Index. Data for SPY ETF is available from 22/01/1993.

b. SHY ETF has been used for bonds. The SHY ETF measures the performance of U.S. Treasury securities that have a remaining maturity of at least one year and less than three years. Data for SHY ETF is available from 22/07/2002. 3. iShares® Asset Class Illustrator has been used for empirical testing. This web-based software helps to back test portfolios.

- The results of rebalancing each 3 portfolio on a quarterly, semi-annual and annual basis have been analyzed. Each rebalanced portfolio was also compared to a non-rebalanced portfolio.

- The Sharpe Ratio (Sharpe, 1994) has been used as a criterion for determination effectiveness of rebalancing strategy. The Sharpe Ratio is a measure of the excess return (or risk Premium) per unit of risk in an investment asset. It is calculated as the return above the risk-free rate divided by its standard deviation. Sharpe Ratio calculation by iShares® “First, you take the annualized risk free rate of return of the 3-month U.S. Treasury bond away from the annualized return of the index. Then, you divide that number by the standard deviation of the annualized return of the index (annualized return of the index-annualized return of the 3-month U.S.)”

Above described methodology can be easily repeated by other researchers. In described methodology there is only 1 constrain: the methodology does not take into account transaction costs which occur due to portfolio rebalancing.

Empirical analysis of results

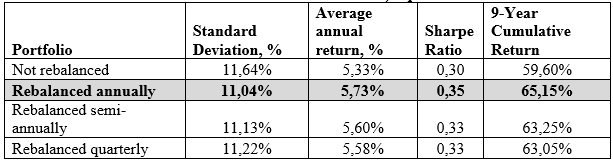

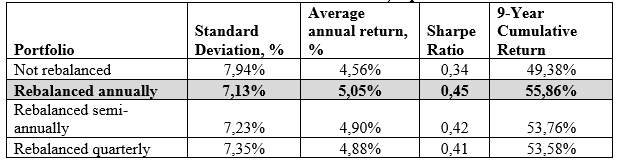

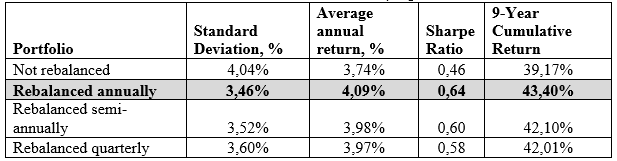

The results of quarterly, semi-annual and annual rebalance frequencies for 3 different portfolios are represented below (see Table 1, Table 2 and Table 3). Data timeframe is 12/31/2002 – 12/31/2011. Empirical analysis shows that any rebalancing timeframe improves the Sharpe Ratio, decreases standard deviation and increases average annual and 9-year cumulative returns. Analysis shows that annual rebalancing improves the Sharpe Ratio in the best way.

Table 1. Asset allocation: Bonds 25%, Equities 75%

Table 1. Asset allocation: Bonds 25%, Equities 75%

Table 2. Asset allocation: Bonds 50%, Equities 50%

Table 2. Asset allocation: Bonds 50%, Equities 50%

Table 3. Asset allocation: Bonds 75%, Equities 25%

Table 3. Asset allocation: Bonds 75%, Equities 25%

In Appendix 1, Appendix 2 and Appendix 3 results of 5 year timeframe testing can be seen. I have analyzed each portfolio for the following data timeframes:

- Data timeframe: 12/31/2002 – 12/31/2007

- Data timeframe: 12/31/2003 – 12/31/2008

- Data timeframe: 12/31/2004 – 12/31/2009

- Data timeframe: 12/31/2005 – 12/31/2010

- Data timeframe: 12/31/2006 – 12/31/2011

Empirical analysis for different timeframes confirms that rebalancing improves the Sharpe Ratio of any portfolio. On the other hand, it might be stated that standard deviation of the portfolio is not always decreased and return of the portfolio is not always increased by periodic rebalancing of the portfolio. But the first observed conclusion about annual rebalancing remains. Different data timeframe analysis shows that annual rebalancing improves the Sharpe Ratio in the best way.

Conclusions

Empirical analysis shows that any periodic rebalancing improves the Sharpe Ratio, but the periodic rebalancing not always decreases the standard deviation or increases the returns of the portfolio. In every scenario and for each portfolio I have observed the annual rebalancing strategy maximally increases the Sharpe Ratio. As for retail investors it can be recommended to conduct annual rebalancing for ETF portfolio. Further research question: can in the long-run (9 years and more) periodic portfolio rebalancing strategy improve not only the Sharpe Ratio, but also decrease standard deviation and increase the returns of the portfolio?

References

- Beach S.L., Rose C.C. (2005). Does Portfolio Rebalancing Help Investors Avoid Common Mistakes? Journal of Financial Planning, May 2005. Available at: http://www.radford.edu/~slbeach/Career/DoesPortReb.pdf

- Beach S.L., Rose C.C. (2008). Portfolio Rebalancing to Overcome Behavioral Mistakes in Investing. Journal of Behavioral Studies in Business. Available at: http://aabri.com/manuscripts/08055.pdf

- Gitsham A. (2011). Rebalancing to the Strategic Asset Allocation, Investment Analytics and Consulting by J.P. Morgan, March 2011 edition. Available at: http://www.jpmorgan.com/cm/BlobServer/IAC_Q12011_Newsletter_PDF.pdf?blobkey=id&blobnocache=true&blo bwhere=1158625602219&blobheader=application%2Fpdf&blobcol=urldata&blobtable=MungoBlobs

- Investment Company Institute (ICI) (2000). “401(k) Plan Participants: Characteristics, Contributions and Account Activity”. Washington, DC, Spring 2000. Available at: http://www.ici.org/pdf/rpt_401k_planp.pdf

- Jaconetti C.M., Kinniry Jr.F.M., Zilbering Y. (2010). Best practices for portfolio rebalancing. Vanguard research, July 2010. Available at: http://www.vanguard.com/pdf/icrpr.pdf

- Kahneman D., Knetsch J., Thaler R. (1991). Anomalies: The Endowment Effect, Loss Aversion and Status Quo Bias. The Journal of Economic Perspectives, 5(1), 193-206.

- Montague B. (2007). The Subtle Art of Rebalancing, How Do You Tell When Your Portfolio Needs a Tune-up? Consulting Group by Citi Smith Barney, 2007. Available at: http://fa.smithbarney.com/facilityfiles/sb050712181629_8c869ab2-423d-e4e0-4d5933e4a4b1f2b2.pdf

- Nersesian J. (2006). Active Portfolio Rebalancing, a Disciplined Approach to Keeping Clients on Track. The Monitor, January / February 2006. Available at: http://www.imca.org/cms_images/file_545.pdf

- Samuelson W., Zeckhauser R. (1988). Status Quo Bias in Decision Making. Journal of Risk and Uncertainty, 1: 759, 1988. Available at: http://www.hks.harvard.edu/fs/rzeckhau/SQBDM.pdf

- Sharpe W.F. (1994). The Sharpe Ratio. Journal of Portfolio Management, 21, Fall, Issue 1 49-58.

- Tokat Y. (2006). Portfolio Rebalancing in Theory and Practice. Vanguard Investment Counseling & Research, Number 31. Available at: https://institutional.vanguard.com/iip/pdf/ICRRebalancing.pdf

- Weinstein S.B., Tsai C.S., Laurie J.M. (2003). The Importance of Portfolio Rebalancing in Volatile Markets. Retirement Planning, July–August. Available at: https://www.altairadvisers.com/downloa/JORPRebalancing%204-03.pdf