Volkov I. (2008). The sales profit in present-day price wars: the example of Telecommunication Company. Global Academic Society Journal: Social Science Insight, Vol. 1, No. 1, pp. 14-21. ISSN 2029-0365. [www.ScholarArticles.net]

Author:

Ivan Volkov, Moscow State Industrial University, Russia

Abstract

Competitiveness is one of the most important conditions to increase company’s profit. Increasing growth speed and volume of profit depends on many factors such as managers’ activity and their knowledge, market conditions and so on. There are many methods how to increase growth speed and volume of profit in up-to-date competitive situation. Many methods are widely used but they are hardly to be used from day to day. Any company needs new methods for increasing its competitiveness and as consequence increasing of company’s profit, too. Company has more advantages than other ones if method was not used by any company before. New method of increasing profit on sales of a company is offered in the paper. The example of Telecommunication Company is illustrated in the paper. The article consists of introduction, essence of competitiveness increasing method by the example of Telecommunication Company Stelton Technology and conclusions. Introduction discovers the main points around a problem of increasing of sales profit. Essence of competitiveness increasing method discovers main points of some methods of increasing profit on sales of wholesale Telecommunication Company.

Introduction

With cable companies around the world offering VoIP (voice-over-Internet protocol), and telephone companies offering IPTV (Internet-protocol television), telecom boundaries have been blurred forever, forcing cablecos and telcos who in previous decades tended their respective gardens into head-to-head competition (Heinrich, 2007). Profit of a company is one of the main economical categories. Profit is the goal of business for any company. Profit is a net income of the company and has some functions in the company, e.g. stimulation of future activity, characterisation of economical effect, source for budgeting. One of the main functions is a characteristic of economical effect of one or another measure, which caused the profit (Gerchikova, 2002). Profit can be measured as difference between selling price and purchase price in the middleman organizations. It should be noted that it is necessary to consider expenses connected with the process of reselling, such as delivery charges, service of transport charges, employers which work in this part of business activity. Planned activity for the profit development should be taken in a company. Increasing of profit can be obtained by increasing quantity and/or quality of reselling product, decreasing charges for organization of reselling process. All these ways are used while company tries to increase its profit. Competition is also good for the companies who, at least in theory, should become more effective organizations under market pressure. In order to get profit, one of the main goals of any company is to attract and remain keep clients. In the battle to capture the clients, companies use a wide range of tactics to ward off competitors. Increasingly, price is the weapon of choice – and frequently the skirmishing degenerates into a price war (Bergen et al., 2000). Price wars between any companies are good for consumers. Lower prices are always welcome news. According to Savitskaya (2006), we should ask “When will telecoms move from price wars to feature wars? And when will they move from a feverish campaign to acquire new customers to a realization that better serving their existing customer base is equally, if not more, important?” Refferring to Kenyon and Cheliotis (2001), modelling of telecom prices is in its infancy, which reflects the immaturity of bandwidth as a commodity. The goal of managerial staff of reselling company is to know how to collect necessary statistical information about sales and recognize the best combination of purchase price and quality. This know-how which lets company to maximize profit on sales of product within one price bracket can be nice tool in a competitive fighting inside modern service and product market.

Essence of competitiveness increasing method: the example of Telecommunication Company

The way how to increase competitiveness owing to optimal choice of quantity and price of purchased product in the Telecommunication Company Stelton Technology Ltd. is viewed. It’s necessary to note that we talk about telecommunication service, which has its properties (Sergeev, 2004):

- intangibility – service could not be touched or tasted. Client can receive information about provided service;

- inseparability – service can not be activated without executor of service; presence and contact of executor with customer are needed;

- temporality – consumption value is very short;most of services can not be stored (except data-bases and so on);

- variability – services depend on conditions of providing;

- possession and property – customer is not owner of service;customer has personal profit using service.

Set increasing of sales does not involve increasing of quantity of employers and servicing equipment. Profit on sales is considered as a difference of selling price and purchase price without charges of organization of reselling process. These charges are considered invariable. First, we will establish conditions, which real wholesale telecommunication company works in:

- presence of several providers with difference of price and quality;

- large volume of selling product (minimum 50 pieces per day);

- absence of Intermediate stores with reselling product (services);

- opportunity to regulate level of selling price depending on quality and customer’s preferences (depending on special feature of product);

- increasing of volume of provided service changes service charges slightly;

- changes of providing quality don’t involve replacement of transportation network.

Telecommunication Company which has number of end-users usually satisfies the conditions. Clients use telephone services of the company, and depending on their wishes can change company (in the case of low quality and/or high price). The company already has providers, customer base and own network. Therefore we can consider that company provides services of different quality. Example of such organization may be any other commercial structure, dealing with resale of services, or having purchased product then reselling it in own net of shops. Company should have suppliers, net of shops, transport. We also may view any wholesale company which satisfies conditions noted above. Let’s suppose that “ordinary” company which does not apply method described in the article has statistics listed in Table 1.

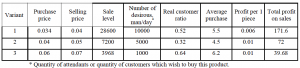

Table 1: The Sales and the profit on sales level in the “ordinary” company, in US dollars (Stelton, Dec. 30, 2007)

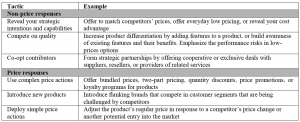

Table 1 shows “classical” example. Company has some providers offering the same product with different quality and price. Company sells this product by retail. Real customer ratio is a relation between number of customers which actually purchased the product and number of ones who desired to do so. The other part of attendants turned to a competitor or is waiting for better quality. It is known that quality and price for product plays crucial role in many customers’ final choice of one or another product offered in the market. Increasing of product quality generally involves increasing both purchase and selling price. Customers wish to buy high quality product for lower price. Customer seeks to buy more products with lower price and high quality than usually (Markeset et al., 2003). However, some customers wish to pay more money for the best quality of product (service). Bergen et al. (2000) point six ways how to fight in price wars using both non-price and price responses (see Table 2). Referring to Beardsley (2004), first, telecommunication companies’ focus should be not just on cutting prices and transferring value to consumers and tax authorities but also on creating the value that will ensure the continued development of networks and technological innovation. In other words, telecom competition promotes telecom investment (Clarke et al., 2004).

Table 2. Ways how to fight price wars (Bergen et al., 2000)

In the case of Telecommunication Company, customers, who receive good quality service, consume it more than those who get low quality service. We don’t speak on the telephone very long when we can’t hear or can’t be heard (or have echo, static, fading, clipping, crackle, cross talk, hollow sounds). We can try to reach one number using service of one Telecommunication Company very long; but if we failed to reach this number, we can wait for better quality or use another companies’ service. Sometimes we tend to solve quite serious matters by phone. Having bad quality of telephone service we don’t understand or miss something from conversation and then we tend to hang up the phone. Quality of product (or service) is very critical in this case. Thus we can speak about average quantity of purchased product (average purchase) as a quality level of this product. We can see from the Table 1 that increasing of quality involves increasing of average quantity of consumed service. This also involves increasing both purchase and selling price. Profit on sales is calculated as a difference between selling and purchase prices. Total profit on sales is calculated as a profit on sales per one piece of sold product multiplied by number of desirous, then multiplied by real customer ratio, in the end multiplied by average purchase (Savitskaya, 2006). Maximum of profit on sales in Telecommunication Company is achieved by selling the cheapest product but not by selling high quality product. (see Table 1). Wholesale Telecommunication Company’s practice shows that it is very difficult to find client who will purchase product at high price with high quality. It is much easier in practice to find clients who want to purchase product at lower price with lower quality. We can see from Table 1 that number of customers decreases depending on increasing of selling price. Customers have indeed benefited greatly from the competition, via higher-quality services and lower rates (Humeid, 2007). My method of increasing of profit on sales offers firms to resell the same products with different quality and purchase price (meaning wholesale purchases from different providers) at the flat price. Obviously company should not resell product at a loss. In this case company has an opportunity to maximize profit on sales choosing provider with the best combination price-quality. Let’s examine one example. Company which resells telecommunication services has some providers of the same service. For example, company uses some alternative telephone providers which let client to connect him or her with another subscriber. Purchase price of such service fluctuates within one price bracket. Quality of the service changes depending on provider too. Sales and profit on sales level achieved using such method are listed in Table 3.

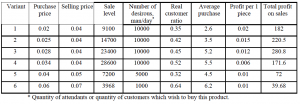

Table 3. Sales and profit on sales level Telecommunication Company using method of combination of providers, in US dollars (Stelton, Dec. 31, 2007)

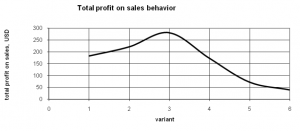

Company has several variants of the same product with different quality from different providers as seen in Table 3. Unlike first example (see Table 1) company has some purchasing variants of service from different providers within one price bracket (see variant 1, 2, 3, 4 in Table 2). Thus company has an opportunity to resell these products at the same price. Selling price does not change, that’s why number of desirous remains the same too (see variant 1, 2, 3, 4 in Table 3). Client can measure quality level of service during receiving of this service only. Having large volume of selling product we can analyze changing of profit on sales under the influence of changing of purchase price and quality. As seen in Table 3, increasing of purchase price involves increasing of quality of product, and thus total sale level changes in the end. Total sale level increases from var.1 (equal 9100 pieces) to var.4 (equal 28600 pieces), as selling price remains the same but quality gets better. Profit per 1 piece is different. It is decreasing from 0.02 US dollar to 0.006 US dollar while purchase price increases. Traditionally it is considered disadvantageous to resell product with smaller profit per 1 piece. Company has to load its technique, put out organization resources less efficiently from profit per 1 piece viewpoint (Michalova, 2006). On the one hand we have increasing of purchase price involving decreasing of profit on 1 piece. But on the other hand we have increasing of quality and whereas increasing of average clients’ purchase. Managerial staff must note such combination of purchase price and product quality wherein total profit on sales achieves maximum. In our example this maximum is achieved in var. 3. Profit per 1 piece is not so small and quality is not as high as at var. 4. We can construct a graph of changing of total profit on sales. As seen from this graph maximum of total profit on sales in the 0.04 price bracket achieved in var.3.

Figure 1. Total profit on sales behaviour depending on variant (Stelton, see Table 3)

As seen from Table 3 and Figure 1, it is most profitable to choose provider of the 3rd variant for reselling its services at 0.04 US dollars.

Conclusions

Competitiveness is a measurement of company’s activity. Effectiveness of this activity is reflected through profit on sales. As seeing from description above, the difference between selling price and purchase price does not always influence the level of profit on sales as a measure of effectiveness of company’s activity. Selling price should not be increased in direct proportion with purchase price to determine maximum of profit on sales. As a matter of fact part of clients can go away to a competitor. We also should take into account changing of quality within one price bracket from one provider to another. Performance data analysis show that it is effective for a wholesale telecommunication company to resell the same products with different quality and purchase price at a flat price as long as this allows to maximize profit on sales choosing provider with the best combination of price and quality.

References

- Beardsley S., Enriquez L., Garcia J. C. (2004) A new route for telecom deregulation. The McKinsey Quarterly, No. 3. Available at: http://www.mckinseyquarterly.com/article_print.aspx?L2=22&L3=0&ar=1437.

- Bergen M. E., Davis S., Rao A. R. (2000) How to Fight a Price War. Harvard Business Review, Harvard. May-April, 2000, pp. 107-116.

- Clarke R. N., Hassett K. A., Ivanova Z., Kotlikoff L. (2004) Assessing the economic gains from telecom competition. National Bureau of Economic Research. NBER Working Paper Series. Working Paper 10482. Available at: http://www.nber.org/papers/w10482.

- Gerchikova I.N. (2002) Menegment: Textbook. 3-rd edition, Moscow, 2002: UNITI, p. 50.

- Heinrich E. (2007) The wireless wars. Canadian Business, 00083100, 9/10/2007, Vol. 80, Issue 18.

- Humeid A. (2007) Watching the telecom price wars, waiting for the feature wars. 360° East Journal, December. Available at: http://www.360east.com/?p=251.

- Kenyon Ch., Cheliotis G. (2001) Stochastic models for telecom commodity prices. Computer Networks, No. 36, pp. 533-555.

- Markeset T., Kumar U. (2003) Design and development of product support and maintenance concepts for industrial systems. Journal of Quality in Maintenance Engineering, No. 9, 2003.

- Michalova V. (2006) Manažment a marketing služieb. Bratislava, Netri, p.17-22. ISBN 80-969567-1-X

- Savitskaya G.V. (2006) Analysis of economic activity of a company. Textbook. 3-rd edition, Moscow, INFRA-M, p. 425.

- Sergeev I.V. (2004) Economics of enterprise. Study Guide. 2nd edition, Moscow. Financi i Statistika, p. 304.

- Stelton Technology Ltd. billing system, Dec 30-31, 2007; service code – 92 (Pakistan).